Carillon Tower Advisers, an investment management company, released its “Carillon Eagle Mid Cap Growth Fund” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. After underwhelming results in Q3, mid-cap stocks made impressive gains in Q4. Mid-cap stocks had a positive year, with every sector performing well. The Russell Midcap Growth Index (up 25.86%) outperformed the Russell Midcap Value Index (up 12.66%) by a significant margin. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

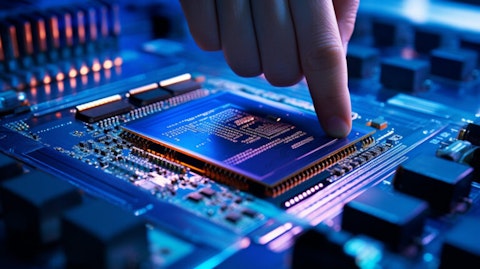

Carillon Eagle Mid Cap Growth Fund featured stocks such as Monolithic Power Systems, Inc. (NASDAQ:MPWR) in the Q4 2023 investor letter. Headquartered in Kirkland, Washington, Monolithic Power Systems, Inc. (NASDAQ:MPWR) designs and develops semiconductor-based power electronics solutions. On January 31, 2024, Monolithic Power Systems, Inc. (NASDAQ:MPWR) stock closed at $602.72 per share. One-month return of Monolithic Power Systems, Inc. (NASDAQ:MPWR) was 5.54%, and its shares gained 27.17% of their value over the last 52 weeks. Monolithic Power Systems, Inc. (NASDAQ:MPWR) has a market capitalization of $28.878 billion.

Carillon Eagle Mid Cap Growth Fund stated the following regarding Monolithic Power Systems, Inc. (NASDAQ:MPWR) in its fourth quarter 2023 investor letter:

“Monolithic Power Systems, Inc. (NASDAQ:MPWR) is a fabless semiconductor manufacturing company with a global footprint. The company’s earnings results were better than feared: Semiconductor industry fundamentals had been mixed, with fluctuating ordering patterns and limited visibility into automotive and industrial end markets. The company’s high-performance, power management semiconductor chips are benefitting from being used in artificial intelligence applications for enterprise data centers, and recent design wins among its customers bode well for future orders.”

A close up view of mmWave Integrated Circuits with a technician pointing out the intricate components.

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 29 hedge fund portfolios held Monolithic Power Systems, Inc. (NASDAQ:MPWR) at the end of third quarter which was 33 in the previous quarter.

We discussed Monolithic Power Systems, Inc. (NASDAQ:MPWR) in another article and shared the list of best performing S&P 500 stocks in the last 10 years. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Most Innovative Economies in 2024: Why WIPO Rankings Are Inaccurate

- 20 Countries with Highest Interest Rates in 2024

- 25 Most Cannabis Consuming-Countries in the World

Disclosure: None. This article is originally published at Insider Monkey.