Miller Value Partners recently released its Q2 2021 Investor Letter, a copy of which you can download here. The Miller Opportunity Trust Class I gained 4.18%, underperforming its benchmark, the S&P 500 Index which returned 8.55% in the same quarter. You should check out Miller Value Partners’ top 5 stock picks for investors to buy right now, which could be the biggest winners of this year.

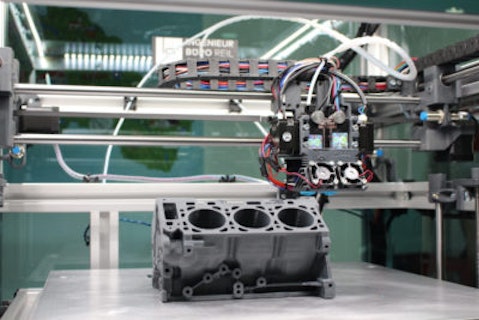

In the Q2 2021 Investor Letter, the fund highlighted a few stocks and Desktop Metal Inc. (NYSE:DM) is one of them. Desktop Metal Inc. (NYSE:DM) designs and markets 3D printing systems. In the last three months, Desktop Metal Inc. (NYSE:DM) stock lost 41%. Here is what the fund said:

“Desktop Metals Inc. (DM) declined 21.29% during the period. The company reported their first quarter results with revenue of $11.3M beating consensus of $9.9M with adjusted EBITDA coming in at -$19.4B slightly ahead of consensus of -$20.6M. The company reaffirmed full year 2021 guidance with revenue expected in excess of $100M exiting the year at a revenue run rate of $160M but lowered adjusted EBITDA guidance to -$60M to -$70M from -$50m to -$60m previously. Over the period, the company announced a number of new processes and materials adding a process for wooden parts, the qualification of 316L stainless steel, qualification of 4140 low alloy-steel and the CE (Conformite Europeenne) mark for their Flexcera resin for use in 3D fabrication of dental prosthetics. By the end of the period, the company filed to sell 2.49M shares from existing shareholders.”

In July, we published an article revealing that Desktop Metal Inc. (NYSE:DM) was one of the 5 Best 3D Printing and Additive Manufacturing Stocks to Buy.

In Q1 2021, the number of bullish hedge fund positions on Desktop Metal Inc. (NYSE:DM) stock decreased by about 17% from the previous quarter (see the chart here), so a number of other hedge fund managers don’t believe in DM’s growth potential. Our calculations showed that Desktop Metal Inc. (NYSE:DM) isn’t ranked among the 30 most popular stocks among hedge funds.

The top 10 stocks among hedge funds returned 231.2% between 2015 and 2020, and outperformed the S&P 500 Index ETFs by more than 126 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Here you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage.

Disclosure: None. This article is originally published at Insider Monkey.