Icahn isn’t afraid of the limelight. He’s been the loudest when it comes to Herbalife. But what he’s doing quietly is much more interesting. Behind the scenes, Icahn is slowly getting back into his old game – casino operators.

Tropicana (NASDAQOTH:TPCA)

Icahn silently acquired much of Tropicana Entertainment when it went into bankruptcy, tossed a heavy $2.5 billion debt burden, and delivered near-control ownership to Carl Icahn in the process. Then Icahn bought more, and more, and more of the casino. He now owns more than 70% of outstanding shares.

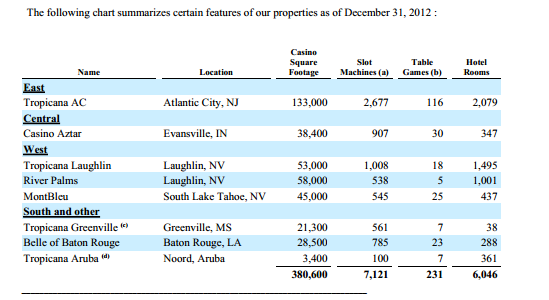

Tropicana may be a small casino operator, but it has significant assets holding down the valuation. The company owns casinos in Nevada, New Jersey, Louisiana, Mississippi, Indiana, and Aruba – all of which are essentially paid-for with cash. Debt used to acquire and build each property disappeared in a 2010 bankruptcy.

Tropicana does very well in less competitive, regional gambling plays. From the company’s latest 10-K, one can see why Tropicana has no need to get competitive – Atlantic City is a drag, but its other casinos are remarkably profitable:

Justifying its current valuation are real assets that give the company serious insulation from a slowdown in travel. Its riverboat in Evansville Indiana may soon get the chance to move on the 50 acres of land the company owns in a move that would strangle water-based competition and give the company lower operating costs. (The central casinos are already the most profitable, so cost-savings would only extend their lead.)

Tropicana has more than 6,000 hotel rooms and 380,000 square feet of casino space, most of which rests in and on land and buildings owned by the company:

No developer could ever license, build, and develop these 8 properties anywhere close to the cost of simply buying out Tropicana. The company claims a $700 million property tax appraisal for 2013 in its latest annual report.

What’s Icahn’s next move?

It’s rare that investors get to invest alongside a world-class activist shareholder who owns a majority stake in any firm. Luckily, Tropicana is tiny – today’s stock prices suggest a market cap of just over $400 million.

The current valuation is unlikely to be the price at which Icahn exits, though. Seeing as Icahn has a control position, his next move will likely follow in the footsteps of several multi-billion casino sales he’s participated in during his rise to the top of the activist investing food chain. Icahn has a knack for selling off casinos – he sold American Casino & Entertainment Properties for $1.3 billion in 2007.

In the worst case scenario, Icahn will make a bid to take it private. Given that he only needs to acquire about 30% of the total outstanding equity, the price tag would come at $120 million assuming no premium to the current trading price. Icahn could easily pay up with the more than $250 million Tropicana holds in cash.

In a best case scenario, Icahn will be ready to make a deal. MGM Resorts International (NYSE:MGM) is a potential suitor, a company with a $6 billion market cap and the financials capable of making a deal.

Synergies would undoubtedly come to fruition, sweetening an acquisition. MGM Resorts International (NYSE:MGM) already owns resorts and casinos in Mississippi, Detroit, and Aruba, and Tropicana’s positions in similar, non-destination locales plus a resort play in Aruba would make for a good combination. MGM Resorts International (NYSE:MGM) also holds a 50% stake in the Grand Victoria, a small casino in Illinois.

For MGM Resorts, a company which has focused on repaying acquisition debt from the boom years of the 2000s and adding bolt-on growth to existing casinos, Tropicana is an easy add-on. Any acquisition would be immediately accretive to MGM Resorts International (NYSE:MGM), giving it more real estate against which it can borrow cheaply and providing an exit route for Tropicana investors.

When Carl Icahn wants to make a move, he certainly will. Expect Icahn to start shopping around his prized hidden asset.

The article Forget Herbalife – Icahn Is up to Something Bigger in Casinos originally appeared on Fool.com and is written by Jordan Wathen.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.