Does Merck & Co., Inc. (NYSE:MRK) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

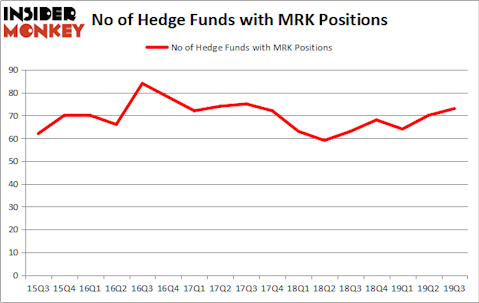

Merck & Co., Inc. (NYSE:MRK) was in 77 hedge funds’ portfolios at the end of December. MRK has experienced a decrease in hedge fund interest lately. There were 80 hedge funds in our database with MRK holdings at the end of the previous quarter. Our calculations also showed that MRK isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Ken Fisher of Fisher Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Keeping this in mind let’s take a gander at the fresh hedge fund action surrounding Merck & Co., Inc. (NYSE:MRK).

What does smart money think about Merck & Co., Inc. (NYSE:MRK)?

At Q4’s end, a total of 77 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MRK over the last 18 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in Merck & Co., Inc. (NYSE:MRK), which was worth $928.5 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $808.5 million worth of shares. AQR Capital Management, Renaissance Technologies, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Kahn Brothers allocated the biggest weight to Merck & Co., Inc. (NYSE:MRK), around 11.45% of its 13F portfolio. Parkman Healthcare Partners is also relatively very bullish on the stock, dishing out 5.78 percent of its 13F equity portfolio to MRK.

Since Merck & Co., Inc. (NYSE:MRK) has experienced bearish sentiment from hedge fund managers, we can see that there were a few fund managers who sold off their full holdings heading into Q4. It’s worth mentioning that Jacob Mitchell’s Antipodes Partners cut the biggest stake of all the hedgies watched by Insider Monkey, totaling an estimated $148.9 million in stock. Ernest Chow and Jonathan Howe’s fund, Sensato Capital Management, also said goodbye to its stock, about $12.1 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 3 funds heading into Q4.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Merck & Co., Inc. (NYSE:MRK) but similarly valued. We will take a look at Chevron Corporation (NYSE:CVX), Wells Fargo & Company (NYSE:WFC), Pfizer Inc. (NYSE:PFE), and Novartis AG (NYSE:NVS). This group of stocks’ market valuations match MRK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVX | 47 | 2391610 | -6 |

| WFC | 79 | 23878918 | 12 |

| PFE | 62 | 4838507 | 4 |

| NVS | 30 | 2054513 | 2 |

| Average | 54.5 | 8290887 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 54.5 hedge funds with bullish positions and the average amount invested in these stocks was $8291 million. That figure was $5164 million in MRK’s case. Wells Fargo & Company (NYSE:WFC) is the most popular stock in this table. On the other hand Novartis AG (NYSE:NVS) is the least popular one with only 30 bullish hedge fund positions. Merck & Co., Inc. (NYSE:MRK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Unfortunately MRK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MRK were disappointed as the stock returned -10.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.