Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

Hedge fund interest in Mercantile Bank Corp. (NASDAQ:MBWM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare MBWM to other stocks including Atento SA (NYSE:ATTO), ChipMOS Technologies (Bermuda) Ltd (NASDAQ:IMOS), and Whitestone REIT (NYSE:WSR) to get a better sense of its popularity.

If you’d ask most market participants, hedge funds are viewed as slow, outdated financial tools of yesteryear. While there are more than 8,000 funds with their doors open today, We choose to focus on the leaders of this club, about 700 funds. It is estimated that this group of investors direct bulk of all hedge funds’ total capital, and by shadowing their unrivaled picks, Insider Monkey has deciphered several investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Our readers will be interested to know that Edward J. Clark was responsible for the last major insider purchase of the company’s common stock, snapping up 385 shares at $31.59 in 2017. The shares are currently trading at $28.25, so the purchase was not exactly a lucrative one for the executive.

Hedge fund activity in Mercantile Bank Corp. (NASDAQ:MBWM)

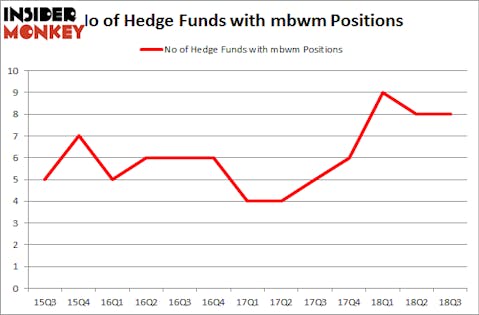

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MBWM over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Mercantile Bank Corp. (NASDAQ:MBWM), with a stake worth $26.4 million reported as of the end of September. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $1.7 million. AQR Capital Management, Algert Coldiron Investors, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Balyasny Asset Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Marshall Wace LLP).

Let’s now take a look at hedge fund activity in other stocks similar to Mercantile Bank Corp. (NASDAQ:MBWM). These stocks are Atento SA (NYSE:ATTO), ChipMOS TECHNOLOGIES INC. (NASDAQ:IMOS), Whitestone REIT (NYSE:WSR), and Scorpio Bulkers Inc (NYSE:SALT). This group of stocks’ market valuations are closest to MBWM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATTO | 7 | 8588 | -2 |

| IMOS | 2 | 25954 | 0 |

| WSR | 3 | 14836 | -1 |

| SALT | 10 | 38899 | -3 |

| Average | 5.5 | 22069 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $32 million in MBWM’s case. Scorpio Bulkers Inc (NYSE:SALT) is the most popular stock in this table. On the other hand ChipMOS TECHNOLOGIES INC. (NASDAQ:IMOS) is the least popular one with only 2 bullish hedge fund positions. Mercantile Bank Corp. (NASDAQ:MBWM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SALT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.