Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze MBIA Inc. (NYSE:MBI) from the perspective of those elite funds.

Hedge fund interest in MBIA Inc. (NYSE:MBI) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare MBI to other stocks including Aptinyx Inc. (NASDAQ:APTX), Hi-Crush Partners LP (NYSE:HCLP), and Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) to get a better sense of its popularity.

To most traders, hedge funds are assumed to be worthless, old investment tools of years past. While there are more than 8,000 funds in operation at present, Our experts choose to focus on the top tier of this group, approximately 700 funds. These hedge fund managers preside over bulk of all hedge funds’ total asset base, and by paying attention to their top investments, Insider Monkey has brought to light numerous investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the key hedge fund action encompassing MBIA Inc. (NYSE:MBI).

What does the smart money think about MBIA Inc. (NYSE:MBI)?

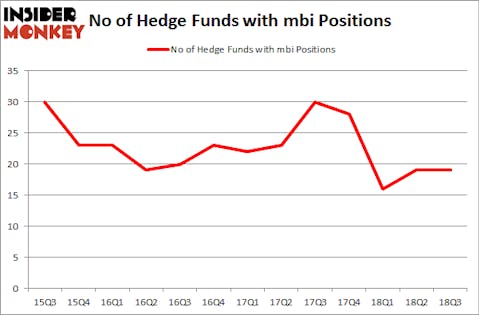

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, no change from one quarter earlier. By comparison, 28 hedge funds held shares or bullish call options in MBI heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Fine Capital Partners held the most valuable stake in MBIA Inc. (NYSE:MBI), which was worth $102.7 million at the end of the third quarter. On the second spot was Kahn Brothers which amassed $48.7 million worth of shares. Moreover, Royce & Associates, Rubric Capital Management, and Millennium Management were also bullish on MBIA Inc. (NYSE:MBI), allocating a large percentage of their portfolios to this stock.

Because MBIA Inc. (NYSE:MBI) has witnessed falling interest from the aggregate hedge fund industry, it’s safe to say that there exists a select few fund managers that slashed their entire stakes in the third quarter. It’s worth mentioning that Glenn Russell Dubin’s Highbridge Capital Management cut the biggest investment of the 700 funds monitored by Insider Monkey, valued at close to $4.5 million in stock. Youlia Miteva’s fund, Proxima Capital Management, also dropped its stock, about $3.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as MBIA Inc. (NYSE:MBI) but similarly valued. We will take a look at Aptinyx Inc. (NASDAQ:APTX), Hi-Crush Partners LP (NYSE:HCLP), Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH), and Tekla Healthcare Investors (NYSE:HQH). All of these stocks’ market caps resemble MBI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APTX | 12 | 198713 | -6 |

| HCLP | 4 | 2804 | -4 |

| RUTH | 15 | 54321 | 1 |

| HQH | 1 | 215 | 0 |

| Average | 8 | 64013 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $64 million. That figure was $287 million in MBI’s case. Ruth’s Hospitality Group, Inc. (NASDAQ:RUTH) is the most popular stock in this table. On the other hand Tekla Healthcare Investors (NYSE:HQH) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks MBIA Inc. (NYSE:MBI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.