The Dow Jones industrial average finally shot past 20,000 points earlier on Wednesday. President Donald Trump’s infrastructure project announcements certainly added a lot of optimism to the financial markets. As Trump signed the executive order to build a large wall between the U.S. and Mexican border, investors have been quick to pick up stocks of corporations that are most likely to take advantage of those building projects.

Trump has not yet given any details about the wall project, but just the prospect alone was enough to make investors bullish. Martin Marietta Materials, Inc. (NYSE:MLM), a construction materials company saw a large gain on the day the executive order was signed. The stock is currently up by 9% year-to-date, and we’re still only in January.

– This article appeared first on ModestMoney.com.

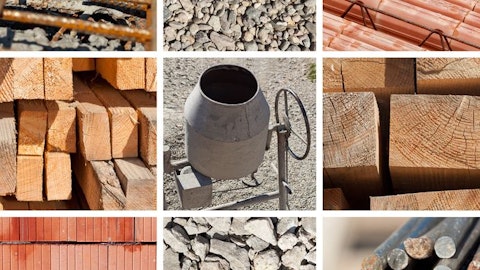

Copyright: lightkeeper / 123RF Stock Photo

Martin Marietta Materials, Inc. (NYSE:MLM) is in the business of producing aggregates for the construction industry, including infrastructure, agricultural, nonresidential, and residential. Broadly speaking, the company operates in two segments: aggregates and specialty products. One service the company provides is that it makes ready-mixed concrete and cement.

The S&P Ratings agency has said it expects MLM to have adequate liquidity, helped by new revolving credit and term loan facilities that refinanced its debt. The company’s gross profit has grown on average by 24% per year for the past four years. And it is showing no signs of slowing down. Martin Marietta conducts business all across the United States, including border states like Texas.

Donald Trump recently said in an interview, “Beginning today, the United States of America gets back control of its borders.” Last year trump predicted the wall would cost between $5 to $10 billion to construct. However, research group Bernstein says that number is too low. Bernstein estimates the wall will be 40 feet tall, 7 feet deep, 10 inches thick, and 1,000 miles long. This means it would require 7 million cubic meters of concrete and 2.4 million tons of cement to build. Add in labor and land acquisition costs, and the total bill for the wall could cost $15 to $25 billion. Under a Trump administration the U.S. is expected to spend billions of dollars on national infrastructure. Between building the wall and fixing highways and other degrading infrastructure there will be a ton of capital up for grabs for cement contractors such as Martin Marietta.

The price to earnings (P/E) ratio of MLM appears to be relatively high at the moment. It’s currently at 38-times, compared to the S&P 500 stock market index’s P/E ratio of 25-times. However, MLM is also expected to grow its earnings faster than the stock market in general. When looking at the P/E ratio of next year, we see that MLM is trading at 21-times 2018 earnings, which is still expensive, but not that bad. Of course another way to measure how rationally-priced a particular stock is, we can use the Benjamin Graham formula.

We can use the following variables to give us an indication of what MLM should be priced at.

Intrinsic value = 6.36 x (8.5 + 2 x 14.5 ) * 4.4 /3.6

So the intrinsic value based on Graham’s formula should be $291.50 per share for MLM. Since the actual stock is trading at only $242 per share as of Thursday’s close, we can assume that Martin Marietta Materials may not be fully priced just yet. But of course this depends on the 14.5% long-term growth rate expected by analysts. So we have to keep in mind that if the analysts are wrong then the equation will not be accurate. Martin Marietta Materials, Inc. (NYSE:MLM) is a great company with a wide economic moat and continues to grow at an impressive rate, given its size. Unfortunately it is not an undervalued company at the moment, but rarely anything is these days. If you have a long-term investment horizon, then buying and holding this stock may be worth considering.

Follow Martin Marietta Materials Inc (NYSE:MLM)

Follow Martin Marietta Materials Inc (NYSE:MLM)

Receive real-time insider trading and news alerts

This author does not hold any shares of MLM and does not plan to buy any in the next 72 hours after writing this post.