Jacob Stephan: Okay. And maybe I could just get a better sense on kind of the quarterly, I guess, impact of that, I mean, are we thinking Q1 as we see the majority of the $9 million to $12 million in Q2, Q3, Q4 kind of steps down to get to the…

Assaf Zipori: Yes, of course. When you look at the numbers, so basically, the bottom line is that the OpEx run rate would be between $92 million and $95 million annually. It should kick in, in Q1 2024. And obviously, there’s a certain level of fluctuation between the Qs given the events that we have in sales, marketing and so on. So — but the annual run rate would be $92 million to $95 million.

Jacob Stephan: Okay. Got it. And I just want to touch on the services. Revenue was up 33% year-over-year. Could you just kind of touch on the strength, what you’re seeing in the services business? Is that Blacksmith is that Digital Forge?

Shai Terem: Yes. Jacob, if you remember about a year ago, we talked about changing our service model to subscription, and adding to it the tools around software with simulation and the automated inspection. And we’re starting to see the fruits of it. So we are starting to see higher level of attach rate right out of the box. When people are buying the printers, but also a higher level of renewal rates. And I think this is where it’s turning to kick in. So we did some revisions to this modem, but a year ago we announced it, and now we’re starting to see the fruits of it.

Jacob Stephan: Okay, I think that’s all the questions I had. Best of luck going forward here, guys. Great seeing you last week.

Shai Terem: Thank you, Jacob.

Operator: Thank you. [Operator Instructions] Our next question comes from Brian Drab with William Blair. Please state your question.

Blake Keating: Hi, guys. Good evening. This is Blake Keating on for Brian. If I could just ask, can you guys provide some additional details about the FX10 backlog you guys mentioned in the prepared remarks? Are these existing customers looking to upgrade from the X7 or add to the fleet? Or is it new customers who are beginning to use 3D printing?

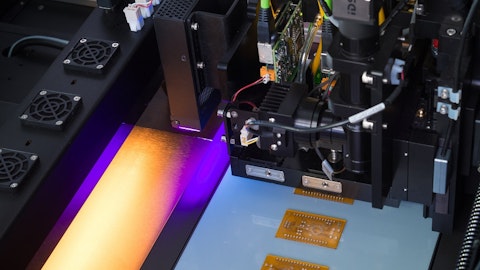

Shai Terem: Thank you for your question. It’s actually both. We are just coming back from Formnext. And if you can see videos of the event, it was very, very impressive and encouraging. Right after we launched it, we had hundreds of potential prospects kind of reaching out into the printer trying to touch it. So we currently see backlog of existing customers, but also new customers which are really interested in this solution. We’re already looking on dozens of orders. What’s really nice about this printer that it’s building up on the legacy X7, the reliability of the solution, but also the price point. So the price point here is around $100,000, which is a very good sweet spot to our channel partners, but also to our customers, especially in times like this with very strange cost of capital environment. Sub-$100,000 solution can easily pass the bar, because it’s much better than the FX20 in times like this.

Blake Keating: Understood. Appreciate the color. And then just building on that, do you anticipate the launch of the Digital Source that could cannibalize some of these demands from the new customers that you’re seeing for newer products like the FX10, PX100 or FX20?

Shai Terem: Actually, exactly the opposite. The Digital Source was launched successfully. And actually, last week in Formnext, we officially started GA. We see a lot of traction from big OEMs that are looking to the solution. And what we’ve seen for the first step is that these big OEMs are pushing our solution into their supply chain or into their customer base. So what we actually see in reality is an increased adoption of our or Digital Source of the printers and materials and software and not cannibalization of it. It’s actually very impressive.