It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like MarineMax Inc (NYSE:HZO).

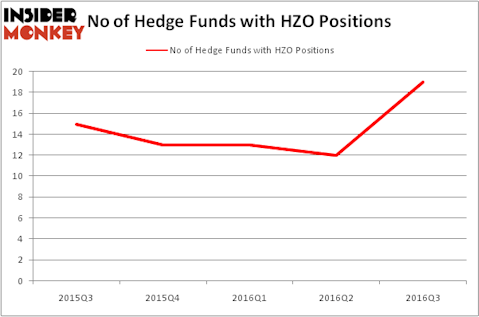

Is MarineMax Inc (NYSE:HZO) undervalued? Money managers are buying. The number of bullish hedge fund positions improved by 7 lately. HZO was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. There were 12 hedge funds in our database with HZO positions at the end of the previous quarter. At the end of this article we will also compare HZO to other stocks including Tower International Inc (NYSE:TOWR), Celldex Therapeutics, Inc. (NASDAQ:CLDX), and Donegal Group Inc (NASDAQ:DGICA) to get a better sense of its popularity.

Follow Marinemax Inc (NYSE:HZO)

Follow Marinemax Inc (NYSE:HZO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

nthony Correia / Shutterstock.com

How are hedge funds trading MarineMax Inc (NYSE:HZO)?

Heading into the fourth quarter of 2016, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a 58% jump from the second quarter of 2016, after three quarters of relatively little movement in the ownership of the stock among hedgies. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Impala Asset Management, managed by Robert Bishop, holds the biggest position in MarineMax Inc (NYSE:HZO). Impala Asset Management has a $23.6 million position in the stock, comprising 1.6% of its 13F portfolio. On Impala Asset Management’s heels is Scopus Asset Management, managed by Alexander Mitchell, which holds a $12.2 million position. Some other professional money managers that hold long positions contain Peter Schliemann’s Rutabaga Capital Management, Richard Driehaus’ Driehaus Capital, and Mark Coe’s Coe Capital Management.

Consequently, key money managers have jumped into MarineMax Inc (NYSE:HZO) headfirst. Renaissance Technologies, managed by Jim Simons, established the largest position in MarineMax Inc (NYSE:HZO). Renaissance Technologies had $1.4 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also initiated a $0.9 million position during the quarter. The other funds with new positions in the stock are Joel Greenblatt’s Gotham Asset Management, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and Mike Vranos’ Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to MarineMax Inc (NYSE:HZO). We will take a look at Tower International Inc (NYSE:TOWR), Celldex Therapeutics, Inc. (NASDAQ:CLDX), Donegal Group Inc (NASDAQ:DGICA), and Meta Financial Group Inc. (NASDAQ:CASH). All of these stocks’ market caps resemble HZO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TOWR | 13 | 67177 | -3 |

| CLDX | 10 | 20218 | -2 |

| DGICA | 3 | 5512 | -1 |

| CASH | 16 | 95501 | 1 |

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $64 million in HZO’s case. Meta Financial Group Inc. (NASDAQ:CASH) is the most popular stock in this table. On the other hand Donegal Group Inc (NASDAQ:DGICA) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks MarineMax Inc (NYSE:HZO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, and that several major funds added the stock to their portfolios in Q3, it may be a good idea to analyze it in detail and potentially include it in your own portfolio.

Disclosure: None