Whether you’re looking for value, growth, income, or a combination of all three, the energy industry has something for every investor. That being said, it can be a little bit harder for the average investor to see the value here, because investing in energy requires you to drill deeper than the average valuation metric.

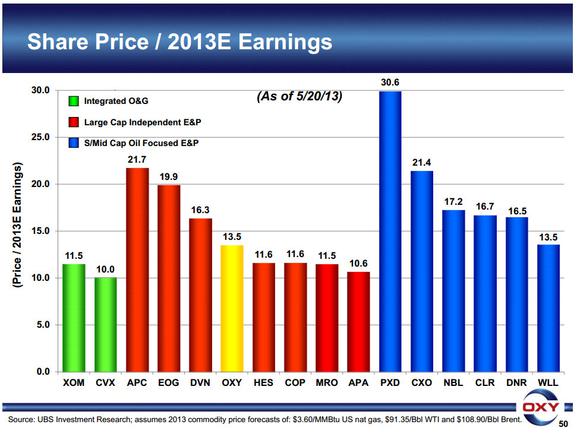

Most investors probably have some familiarity with a price-to-earnings ratio as a form of pegging a value on a company. Unfortunately, as you will soon see, it’s really not the best tool to use to gauge relative values when investing in an oil and gas producer. To demonstrate, let’s look at a chart that groups a number of well-known energy companies by P/E ratio:

Source: Occidental Petroleum Investor Presentation (Opens in a PDF).

Smaller oil-focused E&P company Pioneer Natural Resources (NYSE:PXD) trades at what would appear to be a rather expensive 30.6 times earnings. That’s about twice what Bakken-focused Continental Resources, Inc. (NYSE:CLR) trades at. Both appear to be valued much more expensively than larger independent E&P companies including Marathon Oil Corporation (NYSE:MRO) or Occidental Petroleum Corporation (NYSE:OXY), which could hurt your investing returns.

Drilling down, looking for value

The other thing to keep in mind when looking at a P/E ratio is that it tells only part of the story. Earnings could have been affected by one-time charges resulting from an asset impairment or gains on derivatives used in hedging out oil and gas price volatility. For example, last year, low natural gas prices cost Pioneer Natural Resources (NYSE:PXD) a total of $532.6 million after the company took several writedowns on its Barnett shale dry-gas properties. Meanwhile, Continental Resources, Inc. (NYSE:CLR) took more than $100 million in property impairment charges last year, however, that was more than offset by nearly $200 million in gains on derivatives last year. The volatility of commodity prices can really affect the earnings number, making the P/E ratio a less than optimal metric to use in valuing a potential investment.

A much better metric for an apples-to-apples comparison is the enterprise value-to-EBITDA ratio. This takes into account all of a company’s assets and debt and divides it by its earnings before interest, taxes, depreciation, and amortization. When looking at these same companies and applying that valuation metric, you get a very different investment story:

Source: Occidental Petroleum Investor Presentation.

In this case we can see that Pioneer Natural Resources (NYSE:PXD) is still actually pretty expensive on a relative basis, while Continental Resources, Inc. (NYSE:CLR) also possesses a high-end valuation. On the other hand, Whiting Petroleum Corp (NYSE:WLL) and Marathon Oil Corporation (NYSE:MRO) and very inexpensive on a relative basis. While this metric doesn’t tell you why these companies are cheap, it does provide you with a great starting point when investing with an eye for value.