MeaTech is a global food technology company using advanced biotechnology and engineering capabilities to develop slaughter-free, real meat, which is delicious, nutritious, and safer than conventional meat. The company is aiming to circumvent the unsustainable challenges faced by the conventional animal husbandry sector including the enormous carbon footprint, water resource challenges, and animal welfare issues. MeaTech’s modular factory design allows the company to create a sustainable solution for a wide variety of species including chicken, beef, and pork. The company was the first cultivated meat company to go public with a $US28 million IPO in March 2021, following several funding rounds in 2020 totalling $US16.5 million. MeaTech has recently announced significant management changes with a view to capturing the enormous, cultivated meat growth opportunity. We discuss the implications below.

Management changes

MeaTech recently announced significant management changes aimed at accelerating the company’s transition from a development stage company to a cultivated meat production company. The most significant change is the appointment of Mr Arik Kaufman to the CEO position. Mr Kaufman has founded several Nasdaq and TASE-traded food-tech companies and is a founding partner of the BlueSoundWaves collective led by Ashton Kutcher and Guy Oseary, which recently partnered with MeaTech to accelerate the company’s growth. And importantly, Mr Kaufman has extensive experience in the food-tech and biotech industry.. This management change is aimed at ensuring the company captures the enormous growth opportunity it faces. And the message is clear: MeaTech is focused on leveraging its development stage strengths and accelerating its move towards production.

Fast growing addressable market

MeaTech’s addressable market is expected to growing significantly in the coming two decades. Kearney forecasts global protein demand will nearly double through 2040 driven by global population growth and wealth accumulation. And the alternative meat market is expected to dramatically increase its share of the broader global protein market driven by the growing number of alternative meat products available, and growing consumer demand for meat products which don’t harm animals. As a result, the market for cultivated meat is expected to grow at 41% p.a. between 2025 and 2040, leading to a 35% global meat market share and a $US630 billion revenue opportunity. That’s a significant growth opportunity for the alternative meat sector considering the market is only starting to scale now.

MeaTech’s new management team is focused upon ensuring the company is positioned to benefit from these building structural tailwinds. In the year ahead, the company is planning to launch a pilot plant of cultured fat, build its distribution and marketing capabilities, and expand its intellectual property portfolio.

Under the radar investment opportunity

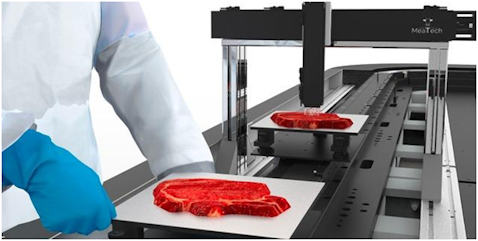

MeaTech is a compelling under-the-radar investment opportunity as the company aspires to transition from a development stage company into a cultivated meat producer ahead of the enormous growth trajectory expected in the alternative meat market. If the company is indeed well positioned to make the transition, as its development stage investments resulted in a bio printing technology which produces consistent, high- quality, and delicious cultivated meat with optimal muscle and fat levels, it holds immense potential in democratising this field. And the recent management changes will help accelerate MeaTech’s commercialization and future growth as the new CEO, Mr Kaufman, is highly experienced at taking companies from development to production. As this plays out, the stock is likely to gain a greater following amongst investors and analysts as it moves from being an under-the-radar opportunity to a leading player in a high growth sector.

Disclaimer: The author was compensated to provide his independent analysis of the company. The author owns no shares nor plans to do so in the near future. The stock market is volatile and investors are advised to do their own research prior to making a decision.