By a lot, too. The Case-Shiller Housing Index is up almost 11% in the last year. Some cities are booming twice as fast. Los Angeles, Detroit, and Las Vegas home prices are up 20% in the last year. All of these are the biggest annual gains since 2006, when the housing bubble peaked.

We’re not in a new housing bubble. Prices are bouncing off the deepest plunge since the Great Depression, and measured against rents and incomes, homes still look cheap. Bloomberg shared an amazing statistic this week: Detroit home prices are still so low that “it takes a mortgage rate of 35.8 percent to make renting more economical [than owning].”

But don’t hold your breath for these gains to continue.

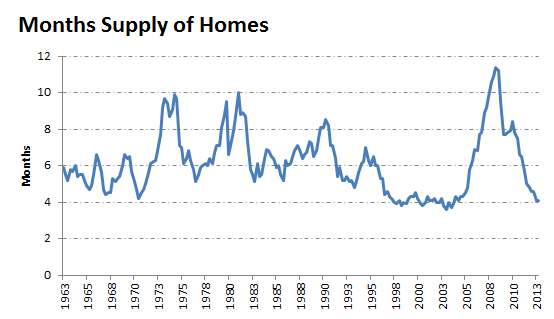

Home prices are surging because the supply of homes on the market is low. The number of homes on the market will now cover only about four months of sales at current rates. That’s the lowest since 2004:

Source: Commerce Department.

But two things happen when supply is this low:

1. Homebuilders have pricing power and are building again. They’re constrained (amazingly) by labor shortages, but new-home construction is up 40% in the last year, and homebuilder confidence is at a seven-year high. As M.D.C. Holdings, Inc. (NYSE:MDC) CEO Larry Mizel put it earlier this year:

The opportunities have never been greater for the large builders. The capital markets are open and I would say in all the years I’ve been in business, this is probably the clearest period of time that I have seen as to the future of the housing industry for those who would have excess to capital.

Home construction is going to continue to boom. That’s great for the economy, but it’s going to add supply to the market and take some of the fuel out of rising home prices.

2. Millions of existing homeowners are gaining enough equity to sell. There are more than two million fewer homeowners underwater on their mortgages today than there were two years ago. As Redfin writes:

Increasing home prices are giving more sellers sufficient equity to sell, and sellers who already had equity are being lured into the market after seeing their neighbor’s homes sell in record time and in fierce bidding wars.

More inventory begets more inventory, too. “I have several clients who are ready to take the plunge and list their homes — they’ve even decluttered and we have the listing ready to hit the MLS,” explained Redfin listing specialist Paul Stone. “The sellers are just waiting to get under contract on a home to buy, at which point we’ll pull the trigger and list their current home.”

This is going to push up supply, which should keep further price gains in check.

So how much should you expect the price of your home to rise over time? The answer might surprise you. Two years ago I sat down with famed Yale economist Robert Shiller. Here’s a transcript of our talk on historical home prices: