With Apple Inc. (NASDAQ:AAPL) trading near $500 again, it’s time to return to the drawing board and look at the King of Cupertino’s valuation. As it turns out, Apple Inc. (NASDAQ:AAPL) still looks tasty at $500.

Low expectations haunt Apple’s stock

The market is a forward-looking mechanism, and when it comes to Apple, the market’s forward look accounts for little (if any) growth in the company’s bottom line beyond inflation.

Assuming investors require a 10% return on their investment in order to take the risk of investing in the stock market, a P/E of 10 suggests that the market believes a company’s underlying earnings growth will not outpace inflation.

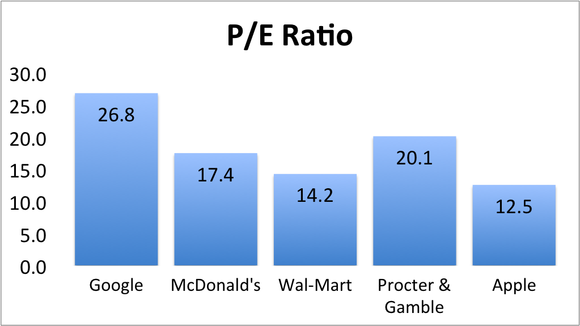

With Apple Inc. (NASDAQ:AAPL) trading at a P/E of 12.5, it’s easy to see the Street has low expectations for the company’s EPS growth — even despite its massive share repurchase program. Even at $500, investors’ expectations for Apple paint a very gloomy picture when compared to other megacap cash cows: Google Inc (NASDAQ:GOOG), The Procter & Gamble Company (NYSE:PG), McDonald’s Corporation (NYSE:MCD), and Wal-Mart Stores, Inc. (NYSE:WMT).

Source: Morningstar.

Relative to free cash flow, Apple Inc. (NASDAQ:AAPL) looks even cheaper.

Source: Morningstar.

The story gets even more confusing when you take into consideration Apple Inc. (NASDAQ:AAPL)’s free cash flow yield. A free cash flow yield refers to the percentage of every dollar of sales a company is able to convert into free cash flow.

Source: Morningstar.

Despite Apple’s uncanny ability to turn a quarter of every dollar of sales into free cash flow, the market refuses to give the stock a premium.

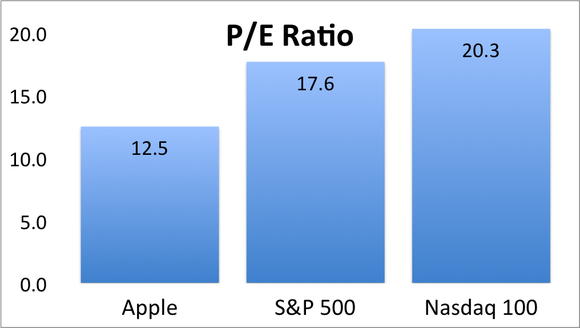

The same story prevails when you compare Apple to all of its peers in the S&P 500 and the Nasdaq 100.

Source: Morningstar.

Source: Morningstar.

Investors who buy Apple Inc. (NASDAQ:AAPL) today are able to lock in a nice dividend yield. If an investing thesis based on the premise that Apple is fundamentally undervalued isn’t enough for investors to get excited about the stock, its dividend may provide the needed kick. Apple’s higher-than-average dividend yield — combined with its excellent prospects as a dividend stock going forward — gives the iMaker a bit more appeal.

Source: Morningstar.

Does Apple deserve such a conservative valuation?

Maybe. But the stock is likely undervalued. With poor expectations already priced into the stock, any upside surprise to the company’s future will likely serve as a nice bonus to the stock’s story. Apple provides investors a unique opportunity to buy a market leader with little downside risk and at least some upside opportunity.

The article Visualizing the Value in Apple Stock originally appeared on Fool.com and is written by Daniel Sparks.

Fool contributor Daniel Sparks owns shares of Apple. The Motley Fool recommends Apple, Google, McDonald’s, and Procter & Gamble. The Motley Fool owns shares of Apple, Google, and McDonald’s.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.