It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 7% during October and average hedge fund losing about 3%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by about 4 percentage points during the first half of Q4, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Lantheus Holdings Inc (NASDAQ:LNTH) during the quarter below.

Is Lantheus Holdings Inc (NASDAQ:LNTH) a sound investment today? Hedge funds are selling. The number of bullish hedge fund bets were trimmed by 1 in recent months. Our calculations also showed that LNTH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a glance at the fresh hedge fund action encompassing Lantheus Holdings Inc (NASDAQ:LNTH).

How have hedgies been trading Lantheus Holdings Inc (NASDAQ:LNTH)?

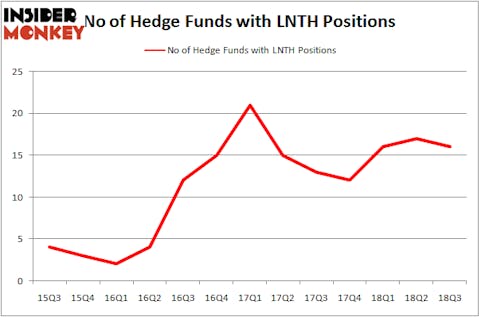

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LNTH over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Lantheus Holdings Inc (NASDAQ:LNTH) was held by Renaissance Technologies, which reported holding $15.5 million worth of stock at the end of September. It was followed by Tamarack Capital Management with a $14.5 million position. Other investors bullish on the company included AQR Capital Management, Raging Capital Management, and Royce & Associates.

Because Lantheus Holdings Inc (NASDAQ:LNTH) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of fund managers who were dropping their entire stakes by the end of the third quarter. Interestingly, Steve Cohen’s Point72 Asset Management said goodbye to the largest investment of the 700 funds watched by Insider Monkey, worth close to $1.1 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also cut its stock, about $0.3 million worth. These transactions are important to note, as total hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lantheus Holdings Inc (NASDAQ:LNTH) but similarly valued. We will take a look at Independent Bank Corporation(MI) (NASDAQ:IBCP), Biglari Holdings Inc (NYSE:BH), TETRA Technologies, Inc. (NYSE:TTI), and Aurinia Pharmaceuticals Inc (NASDAQ:AUPH). All of these stocks’ market caps resemble LNTH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IBCP | 10 | 67693 | 0 |

| BH | 7 | 43738 | 0 |

| TTI | 18 | 28620 | 4 |

| AUPH | 6 | 24047 | -2 |

| Average | 10.25 | 41025 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $65 million in LNTH’s case. TETRA Technologies, Inc. (NYSE:TTI) is the most popular stock in this table. On the other hand Aurinia Pharmaceuticals Inc (NASDAQ:AUPH) is the least popular one with only 6 bullish hedge fund positions. Lantheus Holdings Inc (NASDAQ:LNTH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TTI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.