Is Lamar Advertising Co (NASDAQ:LAMR) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

Lamar Advertising Co (NASDAQ:LAMR) has experienced an increase in hedge fund sentiment recently. At the end of this article we will also compare LAMR to other stocks including Signet Jewelers Ltd. (NYSE:SIG), BorgWarner Inc. (NYSE:BWA), and iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB) to get a better sense of its popularity.

Follow Lamar Advertising Cow (NASDAQ:LAMR)

Follow Lamar Advertising Cow (NASDAQ:LAMR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

leungchopan/Shutterstock.com

With all of this in mind, let’s take a look at the fresh action regarding Lamar Advertising Co (NASDAQ:LAMR).

What does the smart money think about Lamar Advertising Co (NASDAQ:LAMR)?

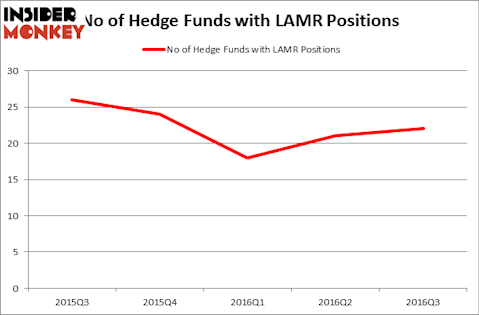

Heading into the fourth quarter of 2016, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from one quarter earlier. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the most valuable position in Lamar Advertising Co (NASDAQ:LAMR). Pzena Investment Management has a $116.1 million position in the stock, comprising 0.7% of its 13F portfolio. Coming in second is Gilchrist Berg of Water Street Capital, with a $45.7 million position; 1.8% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions include Alexander Mitchell’s Scopus Asset Management, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As aggregate interest increased, specific money managers have been driving this bullishness. Scopus Asset Management, managed by Alexander Mitchell, created the most valuable position in Lamar Advertising Co (NASDAQ:LAMR). Scopus Asset Management had $24.1 million invested in the company at the end of the quarter. Jonathan Litt’s Land & Buildings Investment Management also made a $8 million investment in the stock during the quarter. The other funds with brand new LAMR positions are Ray Carroll’s Breton Hill Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Lamar Advertising Co (NASDAQ:LAMR) but similarly valued. We will take a look at Signet Jewelers Ltd. (NYSE:SIG), BorgWarner Inc. (NYSE:BWA), iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB), and American Financial Group (NYSE:AFG). This group of stocks’ market caps are closest to LAMR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIG | 39 | 2132429 | -5 |

| BWA | 26 | 557129 | 4 |

| IBB | 23 | 237514 | 5 |

| AFG | 16 | 126085 | -2 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $763 million. That figure was $259 million in LAMR’s case. Signet Jewelers Ltd. (NYSE:SIG) is the most popular stock in this table. On the other hand American Financial Group (NYSE:AFG) is the least popular one with only 16 bullish hedge fund positions. Lamar Advertising Co (NASDAQ:LAMR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SIG might be a better candidate to consider a long position.

Suggested Articles:

Least Racist Countries In Europe

Most Racist States In America Ranked By Hate Crimes

Most Successful Etsy Shops

Disclosure: None