We came across a bullish thesis on Jumia Technologies AG (JMIA) on Value Investing Subreddit Page by TyNads. In this article, we will summarize the bulls’ thesis on JMIA. Jumia Technologies AG (JMIA)’s share was trading at $2.4 as of May 7th.

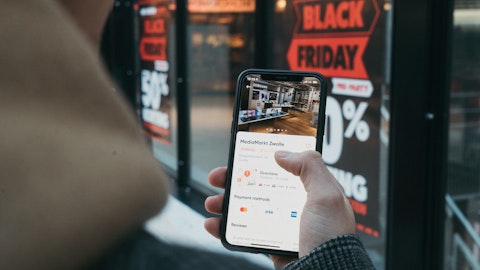

A customer using their phone to access an online commerce platform.

Jumia, once hailed as the “Amazon of Africa,” has spent years plagued by execution missteps, accounting concerns, and a sprawling, unfocused growth strategy that eroded investor confidence. However, the narrative may be quietly shifting. Under CEO Francis Dufay—whose leadership emphasizes profitability first and measured expansion—the company has adopted a more disciplined, value-oriented approach. It has retrenched from marginal markets like South Africa and Tunisia to concentrate on five core countries: Nigeria, Egypt, Morocco, Kenya, and Ivory Coast. This strategic focus has also fueled a rural logistics push, with 56% of Q4 2024 orders originating outside capital cities, signaling traction in hard-to-serve areas through cost-effective, infrastructure-light delivery models. JumiaPay, its fintech layer, is growing steadily with mobile payments, utility billing, and Buy Now, Pay Later features, posting 3.3 million transactions in Q4, up 11% year-over-year. While not yet transformative, the consistent growth across seven countries strengthens platform stickiness and opens margin expansion potential. Meanwhile, the company leverages partnerships like its Starlink distribution deal in Nigeria to extend its reach without heavy capex. Operationally, the shift is visible—Q4 operating loss narrowed to $17.3M from $27.2M the prior year, and full-year losses declined 10% to $66M. Jumia’s $133.9M cash position, fortified by an August 2024 ATM raise, shows prudent capital management. Importantly, constant currency metrics reveal real growth: while USD revenue fell 10%, it rose 17% in constant currency; GMV declined 4% nominally but surged 28% when adjusted for FX. For 2025, Jumia guides for 10–15% GMV growth and a further 28–33% improvement in pre-tax losses—reflecting grounded expectations. With a market cap under $300M, narrowing losses, and a refined focus, Jumia now resembles a mispriced asset with optionality. While risks remain high, the potential for long-term asymmetric returns is back on the table.

Jumia Technologies AG (JMIA) is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 14 hedge fund portfolios held JMIA at the end of the fourth quarter which was 12 in the previous quarter. While we acknowledge the risk and potential of JMIA as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than JMIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.