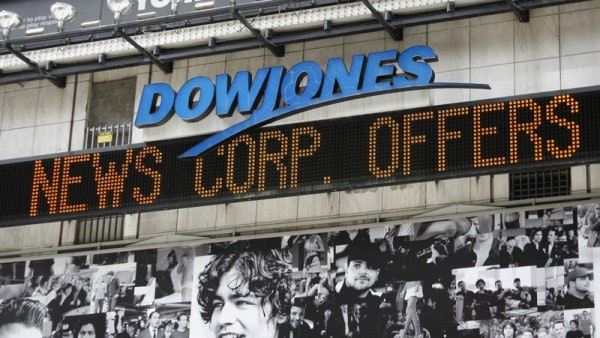

The performance of the stock market today provides a particularly prescient example of why investors shouldn’t watch stock values on a day-to-day basis. After being down nearly 200 points this morning, the Dow Jones Industrial Average has regained ground and is currently off by only 75 points.

I’m not saying this to be flippant, but rather because virtually every other housing-market indicator points to a recovery. Last week, for example, the National Association of Realtors reported that existing-home sales increased in April by 9.7% on a year-over-year basis. I know it’s easy to look at statistics and have your eyes gloss over, but a nearly 10% year-over-year increase is nothing to sneeze at.

This was soon followed up by a report from the Department of Commerce (link opens PDF) that new-home sales had followed suit last month, shooting higher by 29% in April compared with the same month last year. And just yesterday, the widely watched Case-Shiller home price index showed that housing prices increased by 10.9% over 2012, while real-estate website Zillow Inc (NASDAQ:Z) noted that the number of underwater homeowners had declined over the same time period.

The point I’m trying to make here is that the one somewhat closely followed metric released today (the MBA mortgage application index) couldn’t truly be the source of the Dow’s plunge — particularly when the index was down by almost 200 points earlier.

So what’s the explanation?

As best as I can tell, it’s complete conjecture. And what does that conjecture have to deal with? The Federal Reserve. Here’s a headline from Bloomberg: “U.S. Stocks Retreat Amid Concern Fed Will Taper Stimulus.” And here’s one from Reuters: “Wall Street retreats from record levels on Fed worries.”

To paraphrase those articles, the Federal Reserve kinda-sorta intimated last week that it may or may not reduce, expand, or leave untouched its bond-buying program known as QE3 over the next few months. Let me interpret that for you: There’s no reason to believe that the Fed is seriously considering tapering the program, just as there’s no reason to believe that the Fed is seriously considering increasing it or leaving it be.

In other words, these conjectures about the central bank are just a pretext. The market is dropping because that’s what markets do sometimes. They go up, and they go down.

With respect to individual stocks, there does seem to be a reliable explanation for banks’ outperformance. Shares of both JJPMorgan Chase & Co. (NYSE:JPM) and Bank of America Corp (NYSE:BAC) are up moderately following the FDIC’s report on quarterly bank performance. According to the agency, domestic banks and savings institutions earned the largest quarterly profit on record in the first three months of 2013. Given that JPMorgan Chase & Co. (NYSE:JPM) and Bank of America Corp (NYSE:BAC)are the nation’s largest and second-largest banks by assets, respectively, it makes sense that the market would reward them accordingly. For the year, JPMorgan Chase & Co. (NYSE:JPM) stock is up 25%, while Bank of America stock is higher by 15%.

The article The Dow’s Down 75 Points — Who Cares? originally appeared on Fool.com.

John Maxfield owns shares of Bank of America. The Motley Fool owns shares of Bank of America and JPMorgan Chase.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.