With these types of dividend growth rates and such a long dividend streak it is easy to see why Johnson & Johnson is considered a favorite among dividend growth investors. It is also why I purchased Johnson & Johnson (NYSE:JNJ) in my dividend reinvestment plan a few years ago.

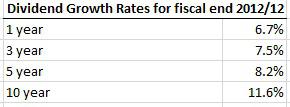

Recently when I completed my full analysis of JNJ, I started to discover that this dividend king’s impressive dividend growth rates may be slowing. If you look at the previous table you can see that dividend growth rates have already been slowing with the one and 3 year rates coming in at 6.7% and 7.5%, both below the 5 and 10 year rates.

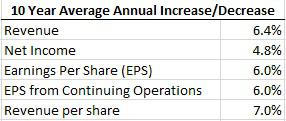

In order for a company to continually increase dividends in a sustainable manner they need to have a corresponding increase in earnings so they can pay for the increasing dividends. When Johnson & Johnson (NYSE:JNJ) is examined you can see that their dividends having been increasing at a faster rate than earnings.

EPS for the past 10 years has increased by 6%, while the dividends increased by 11.6%. With dividends increasing almost twice as fast as earnings it is becoming easier to understand why dividend growth has slowed in recent years. This is not a sustainable trend and I’d expect dividend growth to be lower than the 10 year dividend growth rate going forward.

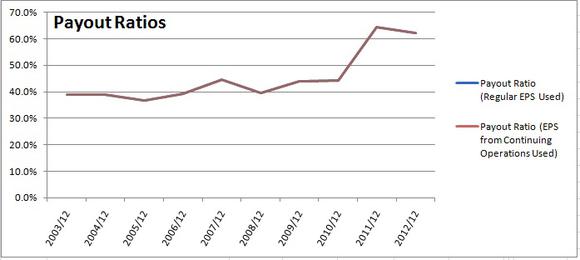

For a company to increase dividends in a sustainable manner at rates well above the earnings growth they need to have a low payout ratio. A lower payout ratio means the company is using a smaller percentage of its earnings to pay for dividends. A low payout ratio is a good thing as it means there is room for dividend growth while still having money to fund operations and the company’s growth initiatives.

When you look at the 10 year payout ratio chart, you can see the rising payout ratio with it sitting at 62.2% as of the most recent fiscal year end. This upward trend is expected considering earnings growth has lagged dividend growth.

For a company like Johnson & Johnson (NYSE:JNJ) you’d like to see a payout ratio of 30% to 60%. With a current ratio just above 60% I expect dividend growth to be roughly in line with earnings growth or slightly lower. Another indicator of slowing dividend growth is the current payout ratio above the 5 and 10 year averages. So far everything I’ve seen points to slowing dividend growth.

You can only gain so much insight looking at historical trends and data and eventually you have to look to the future. By using a combination of historical trends and future estimates a reasonable guess at future dividend growth can be determined. If Johnson & Johnson’s 5 year estimated EPS growth of 6.4% is used and you do a little math you’d get a 5 year annual dividend growth rate of 4.3%.

As you can see, the 5 and 10 year payout ratio averages point to dividend growth below 1%. In fact, using the 10 year payout ratio average leads to negative dividend growth. Johnson & Johnson (NYSE:JNJ) has been paying out increasing dividends for 50 years, and I expect this trend to continue, so I don’t think a negative growth rate (a dividend cut) is a realistic. It’s unlikely that Johnson & Johnson would compromise its strong dividend history with a dividend cut unless its payout ratio was consistently over 100%. A more realistic payout ratio for Johnson & Johnson going forward is 60% and this would suggest a 4.3% annual dividend increase for the next five years.

A 4.3% increase is not that appealing considering Johnson & Johnson’s past performance, so you might want to consider looking for better dividend growth rates among its competitors in the drug industry. Here are three dividend growth candidates to consider.

These competitors all have past dividend growth rates greater than 9%, dividend yield’s above 2.0%, lower payout ratios, and higher estimated earnings growth. Of these competitors I’d start looking into Cardinal Health, Inc. (NYSE:CAH) first as its managed 17 years of consecutive dividend increases while keeping its payout ratio low and dividend growth rates high. It’s also expected to grow the most over the next 5 years.

is an interesting candidate, but because of its short dividend streak of 6 years compared to Johnson & Johnson (NYSE:JNJ)’s 50 years it is a bit like comparing apples to oranges from a dividend perspective. I’d feel much more comfortable with the safety of Johnson & Johnson’s dividend. It takes a special company to increase their dividend for half a century.

is a well known large international pharmaceutical company. I wouldn’t say it has the international presence of Johnson & Johnson, but it is up there. Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) Industries has a more respectable dividend streak of 13 years, but it’s still a few years short of Cardinal Health and well short of Johnson & Johnson’s 50 years. Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) is based in Israel, and listed on the NYSE as an ADR so the dividend payments can fluctuate with changing currencies.

Conclusion

Johnson & Johnson (NYSE:JNJ) has been considered a dividend growth star for a number of years now. Their dividend streak of 50 consecutive years with dividend increases is very impressive as only a handful of companies have been able to reach this milestone. While you would have had good dividend growth in the past I think these rates will drop. The company’s payout ratio has been increasing over the years and I don’t think they’ll want it to go much higher. If the 5 year estimated EPS growth rate of 6.4% is roughly accurate then I expect the dividend growth will range from 4% to 6% per year going forward.

To see the full dividend stock analysis for Johnson & Johnson and my target buy price click here.

The article Will Dividend Growth for This Dividend King Start Slowing? originally appeared on Fool.com and is written by Michael Weber.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.