Something that sets us Foolish investors apart is that we like to be in control of our own finances. There’s nothing wrong with investing in an index fund, but we like to decide which companies will guide us to a financially healthy retirement.

One very popular stock for many a retirement portfolio –including “The World’s Greatest” — reported this morning, and investors are pleased with what they see. Read below to see why this stock — Johnson & Johnson (NYSE:JNJ) — is up today, and at the end, I’ll offer up access to a special premium report on the company.

Just the numbers

| Actual | Vs. Expectations | Vs. Q1 2012 | |

|---|---|---|---|

| Revenue | $17.5 billion | Beat by $100 million | +8.5% |

| Earnings Per Share | $1.44 | Beat by $0.04 | +5.1% |

Sources: E*Trade, SEC filings. These results actually exclude a $600 million, one-time charge for litigation expenses and the company’s acquisition of Synthes.

Because Johnson & Johnson (NYSE:JNJ) is such a massive medical conglomerate, it helps to break down the company into its three segments:

- Consumer: Sells over the counter (OTC) medicines and products, accounting for 21% of all sales.

- Pharmaceuticals: Develops prescription medications, accounting for 39% of all sales.

- Medical devices and diagnostics: Offers larger, more complicated machines to medical establishments, accounting for 40% of all sales.

Source: SEC filings.

Source: SEC filings.

Source: SEC filings.

While it might seem that the slow growth in the consumer sector would be disappointing, it actually was encouraging. The last three years have seen sales of Tylenol and Motrin fall as the company addressed production problems at its Puerto Rico and Pennsylvania plants.

Pharmaceuticals, on the other hand, were both higher than expected and showed tremendous growth. Sales of Invega (a drug for schizophrenia), Stelara (a psoriasis treatment), Simponi (an arthritis medicine), Remicade (an anti-inflammatory), and Prezista (an HIV treatment) all were major contributors to this growth.

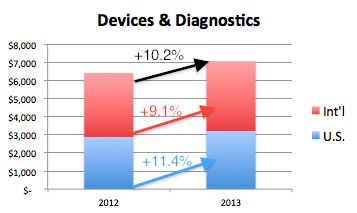

And even though sales for medical devices were softer than expected, they still showed solid 10% growth. That was helped primarily by the acquisition of Synthes, as well as sales of electrophysiology and cardiovascular products, and the company’s 1-Day Acuvue disposable contact lenses.

The article Why Johnson & Johnson Stock Is Boosting the Dow originally appeared on Fool.com.

Fool contributor Brian Stoffel owns shares of Johnson & Johnson. The Motley Fool recommends Johnson & Johnson. The Motley Fool owns shares of Johnson & Johnson.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.