Is Jack in the Box Inc. (NASDAQ:JACK) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

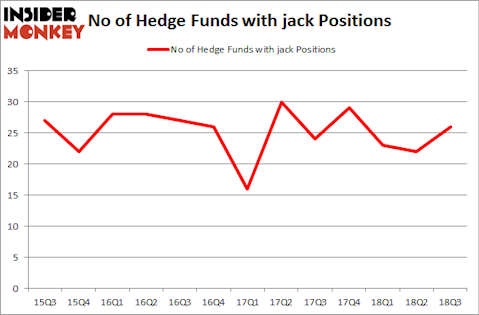

Jack in the Box Inc. (NASDAQ:JACK) was in 26 hedge funds’ portfolios at the end of the third quarter of 2018. JACK investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. There were 22 hedge funds in our database with JACK holdings at the end of the previous quarter. Our calculations also showed that jack isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action surrounding Jack in the Box Inc. (NASDAQ:JACK).

What have hedge funds been doing with Jack in the Box Inc. (NASDAQ:JACK)?

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. On the other hand, there were a total of 29 hedge funds with a bullish position in JACK at the beginning of this year. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Barry Rosenstein’s JANA Partners has the largest position in Jack in the Box Inc. (NASDAQ:JACK), worth close to $145.5 million, accounting for 4.4% of its total 13F portfolio. The second most bullish fund manager is Israel Englander of Millennium Management, with a $53.7 million position; 0.1% of its 13F portfolio is allocated to the company. Some other members of the smart money that are bullish contain Paul Marshall and Ian Wace’s Marshall Wace LLP, Matthew Knauer and Mina Faltas’s Nokota Management and Michael Doheny’s Freshford Capital Management.

Consequently, key money managers have jumped into Jack in the Box Inc. (NASDAQ:JACK) headfirst. Blue Mountain Capital, managed by Andrew Feldstein and Stephen Siderow, initiated the largest position in Jack in the Box Inc. (NASDAQ:JACK). Blue Mountain Capital had $2.3 million invested in the company at the end of the quarter. Clifton S. Robbins’s Blue Harbour Group also made a $2 million investment in the stock during the quarter. The other funds with brand new JACK positions are Paul Tudor Jones’s Tudor Investment Corp, Matthew Hulsizer’s PEAK6 Capital Management, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now take a look at hedge fund activity in other stocks similar to Jack in the Box Inc. (NASDAQ:JACK). We will take a look at Trustmark Corp (NASDAQ:TRMK), Arena Pharmaceuticals, Inc. (NASDAQ:ARNA), B2Gold Corp (NYSEMKT:BTG), and Cambrex Corporation (NYSE:CBM). All of these stocks’ market caps are closest to JACK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRMK | 11 | 32436 | 1 |

| ARNA | 25 | 411535 | 2 |

| BTG | 14 | 65025 | 2 |

| CBM | 17 | 46892 | 2 |

| Average | 16.75 | 138972 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $139 million. That figure was $480 million in JACK’s case. Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) is the most popular stock in this table. On the other hand Trustmark Corp (NASDAQ:TRMK) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Jack in the Box Inc. (NASDAQ:JACK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.