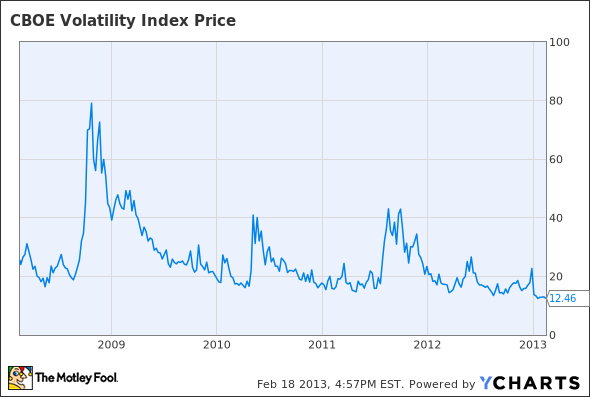

Options are both a misunderstood and dangerous tool for retail investors. You can quickly make a lot of money using options — and you can lose a lot of money just as quickly. But with volatility at a new low, it may be time to consider options as a way to make long-term bets on stocks.

Options are on sale by recent standards

There are four main factors that go into determining what an option is worth: the price of the stock, the strike price, the time to expiration, and volatility. Investors can choose stocks, strikes, and expirations that fit their goals and strategies at any time, but volatility is not something any single investor can determine.

But you’ll notice that the index is at a new low, having fallen rapidly since the fiscal-cliff negotiations. This has the effect of making the cost of options lower. An option with the same underlying stock at the same price with the same duration costs less than it has in years, which makes options attractive. So how can we use options?

Put/call strategy

The strategy you employ will depend on what investments you’re looking at, but I’d like to focus on two: a put/call strategy and LEAPS. I don’t advocate short-term options, because the market can swing in unknown directions by the day. The longer the option, the more time you have for your strategy to play out.

A put/call strategy involves buying both the put and the call of a stock with a strike price as close to the current stock price as possible. It’s profitable if a stock moves up or down a lot before the expiration date. Below, I’ll go over some examples to demonstrate this.

This strategy also has the advantage of being long volatility, meaning that if volatility rises, the options will become more valuable if the stock doesn’t move. If volatility goes up and the stock moves dramatically, all the better.

Options for the future

Another strategy is buying LEAPS, or long-term equity anticipation securities, which are simply long-dated options. There are currently January 2015 options available on the market, nearly two years in length. If you think a stock will go far during the next two years, then this can be a profitable strategy.

A long LEAPS strategy is when you bet that a stock will move higher before the options expire. They allow you to expose your portfolio to more upside than just buying the stock. I’ll use my own personal position in SunPower Corporation (NASDAQ:SPWR) to illustrate how this works below.

On the downside, you can buy puts in companies you think are in trouble. If, for example, you think Best Buy Co., Inc. (NYSE:BBY) won’t last through the next two years because of deteriorating finances, you may buy out-of-the-money puts. A January 2015 $10 strike price put costs $1.19 per share right now. If the stock falls below $8.81, you have a profitable bet that was relatively inexpensive.

You can use a put/call strategy with LEAPS as well, which may be useful for boom-or-bust stocks.