Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Zynga Inc (NASDAQ:ZNGA) to find out whether it was one of their high conviction long-term ideas.

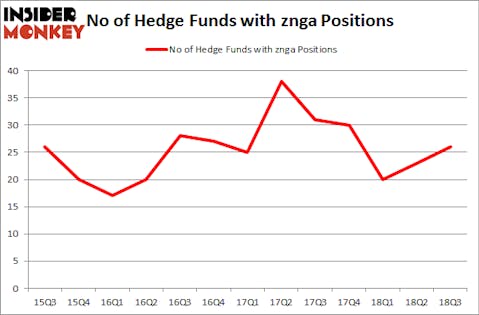

Is Zynga Inc (NASDAQ:ZNGA) a healthy stock for your portfolio? The smart money is becoming more confident. The number of long hedge fund bets went up by 3 lately. Our calculations also showed that znga isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most investors, hedge funds are seen as slow, old financial vehicles of years past. While there are over 8,000 funds with their doors open at present, We look at the moguls of this club, about 700 funds. These hedge fund managers command most of all hedge funds’ total asset base, and by tracking their top investments, Insider Monkey has unearthed a number of investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

We’re going to go over the recent hedge fund action regarding Zynga Inc (NASDAQ:ZNGA).

Hedge fund activity in Zynga Inc (NASDAQ:ZNGA)

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ZNGA over the last 13 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in Zynga Inc (NASDAQ:ZNGA) was held by Iridian Asset Management, which reported holding $153.1 million worth of stock at the end of September. It was followed by Cadian Capital with a $109.4 million position. Other investors bullish on the company included D E Shaw, AQR Capital Management, and Black-and-White Capital.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Iridian Asset Management, managed by David Cohen and Harold Levy, assembled the most valuable position in Zynga Inc (NASDAQ:ZNGA). Iridian Asset Management had $153.1 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $33.9 million position during the quarter. The other funds with brand new ZNGA positions are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, Adam Wolfberg and Steven Landry’s EastBay Asset Management, and Nick Niell’s Arrowgrass Capital Partners.

Let’s also examine hedge fund activity in other stocks similar to Zynga Inc (NASDAQ:ZNGA). We will take a look at Blueprint Medicines Corporation (NASDAQ:BPMC), Eastgroup Properties Inc (NYSE:EGP), Signet Jewelers Limited (NYSE:SIG), and Compania de Minas Buenaventura SA (NYSE:BVN). This group of stocks’ market values resemble ZNGA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BPMC | 27 | 614433 | 3 |

| EGP | 5 | 17676 | -3 |

| SIG | 26 | 383109 | 3 |

| BVN | 4 | 22280 | -3 |

| Average | 15.5 | 259375 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $259 million. That figure was $614 million in ZNGA’s case. Blueprint Medicines Corporation (NASDAQ:BPMC) is the most popular stock in this table. On the other hand Compania de Minas Buenaventura SA (NYSE:BVN) is the least popular one with only 4 bullish hedge fund positions. Zynga Inc (NASDAQ:ZNGA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BPMC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.