Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Yelp Inc. (NYSE:YELP).

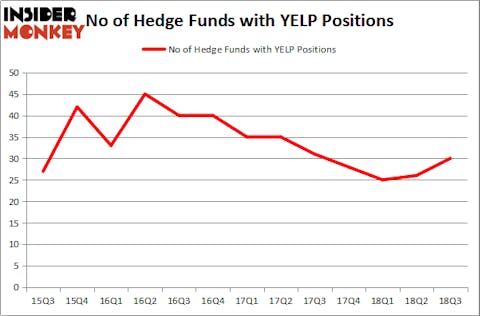

Yelp Inc. (NYSE:YELP) was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. YELP shareholders have witnessed an increase in support from the world’s most elite money managers in recent months. There were 26 hedge funds in our database with YELP holdings at the end of the previous quarter. Nonetheless, there weren’t many billionaires among those investors bullish on Yelp Inc. as other stocks attracted them (if you wont know which stocks have been more interesting to the wealthiness hedge fund managers take a look at the list of 30 stocks billionaires are crazy about: Insider Monkey billionaire stock index). We don’t find this data to be sufficient for us to conclude whether Yelp Inc. is worth purchasing or not, and that’s why will continue examining it.

In the 21st century investor’s toolkit there are many metrics stock market investors have at their disposal to assess publicly traded companies. Two of the best metrics are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the broader indices by a very impressive amount (see the details here).

dennizn/shutterstock.com

During our careful research about the company, we stumbled upon Greenhaven Road Capital’s investor letter, in which the fund presents its views on the stock. We bring you here that part of the letter:

“We discussed Yelp in detail in Greenhaven’s Q2 letter. The initial indications are that the transition away from one-year contracts and toward more flexible, “cancelable at any time” commitments has gone well. As management said in their quarterly letter to shareholders (Link):

“We are pleased with how the transition has gone. Clients have responded well to the increased flexibility and our salesforce has closed more new deals than ever before. We added a record number of advertisers in the quarter, and trial conversion and client retention were consistent with our expectations.”

There remains the possibility of increased traction of new offerings, improved monetization, operating leverage, and multiple expansion.”

Continuing with our study of the stock, we’ll further review the fresh hedge fund action encompassing it.

Hedge fund activity in Yelp Inc. (NYSE:YELP)

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from one quarter earlier. On the other hand, there were a total of 28 hedge funds with a bullish position in YELP at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

As aggregate interest increased, key money managers have jumped into Yelp Inc. (NYSE:YELP) headfirst. Hitchwood Capital Management, managed by James Crichton, assembled the largest position in Yelp Inc. (NYSE:YELP). Hitchwood Capital Management had $29.5 million invested in the company at the end of the quarter. Paul Reeder and Edward Shapiro’s PAR Capital Management also made a $24.6 million investment in the stock during the quarter. The following funds were also among the new YELP investors: Charles Clough’s Clough Capital Partners, Dmitry Balyasny’s Balyasny Asset Management, and Adam Wolfberg and Steven Landry’s EastBay Asset Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Yelp Inc. (NYSE:YELP) but similarly valued. These stocks are Stamps.com Inc. (NASDAQ:STMP), Chesapeake Energy Corporation (NYSE:CHK), Entegris, Inc. (NASDAQ:ENTG), and IntelliPharmaCeutics International Inc. (TSE:I). This group of stocks’ market caps are closest to YELP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STMP | 38 | 600765 | 6 |

| CHK | 22 | 213997 | 3 |

| ENTG | 25 | 478841 | 0 |

| I | 37 | 1128740 | 14 |

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $606 million. That figure was $1.02 billion in YELP’s case. Stamps.com Inc. (NASDAQ:STMP) is the most popular stock in this table. On the other hand Chesapeake Energy Corporation (NYSE:CHK) is the least popular one with only 22 bullish hedge fund positions. Yelp Inc. (NYSE:YELP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard STMP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.