You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

One of the stocks that has registered an increase in hedge fund sentiment lately is Yandex NV (NASDAQ:YNDX). However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Spectrum Brands Holdings, Inc. (NYSE:SPB), Crown Holdings, Inc. (NYSE:CCK), and Qorvo Inc (NASDAQ:QRVO) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

cherezoff / shutterstock.com

With all of this in mind, we’re going to analyze the recent action surrounding Yandex NV (NASDAQ:YNDX).

Hedge fund activity in Yandex NV (NASDAQ:YNDX)

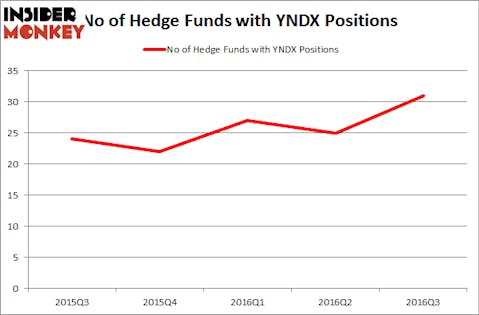

At the end of the third quarter, 31 hedge funds tracked by Insider Monkey were bullish on Yandex, up by 24% from the end of June. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Dmitry Balyasny’s Balyasny Asset Management has the number one position in Yandex NV (NASDAQ:YNDX), worth close to $80.9 million, corresponding to 0.5% of its total 13F portfolio. The second largest stake is held by Discovery Capital Management, led by Rob Citrone, holding a $49.6 million position; 1.1% of its 13F portfolio is allocated to the company. Remaining members of the smart money with similar optimism comprise William B. Gray’s Orbis Investment Management, Kevin D. Eng’s Columbus Hill Capital Management, and Richard Driehaus’ Driehaus Capital.