Before we spend many hours researching a company, we’d like to analyze what insiders, hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of W&T Offshore, Inc. (NYSE:WTI).

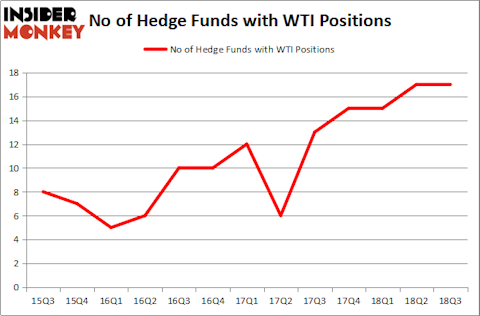

W&T Offshore, Inc. (NYSE:WTI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of September. At the end of this article we will also compare WTI to other stocks including BrightSphere Investment Group plc (NYSE:BSIG), , and Engility Holdings Inc (NYSE:EGL) to get a better sense of its popularity.

To most investors, hedge funds are assumed to be unimportant, outdated investment vehicles of the past. While there are over 8,000 funds with their doors open at present, Our researchers choose to focus on the top tier of this group, approximately 700 funds. These hedge fund managers administer the majority of the hedge fund industry’s total capital, and by tracking their first-class picks, Insider Monkey has spotted several investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the new hedge fund action regarding W&T Offshore, Inc. (NYSE:WTI).

Hedge fund activity in W&T Offshore, Inc. (NYSE:WTI)

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, representing no change from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards WTI over the last 13 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the most valuable position in W&T Offshore, Inc. (NYSE:WTI), worth close to $68 million, accounting for 0.1% of its total 13F portfolio. On Renaissance Technologies’s heels is AQR Capital Management, managed by Cliff Asness, which holds a $27.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism consist of Israel Englander’s Millennium Management, Robert Polak’s Anchor Bolt Capital and Noam Gottesman’s GLG Partners.

Seeing as W&T Offshore, Inc. (NYSE:WTI) has witnessed falling interest from the entirety of the hedge funds we track, we can see that there was a specific group of funds that decided to sell off their full holdings by the end of the third quarter. Intriguingly, Matthew Hulsizer’s PEAK6 Capital Management cut the biggest position of all the hedgies tracked by Insider Monkey, comprising close to $0.3 million in call options, and Glenn Russell Dubin’s Highbridge Capital Management was right behind this move, as the fund dropped about $0.2 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to W&T Offshore, Inc. (NYSE:WTI). We will take a look at BrightSphere Investment Group plc (NYSE:BSIG), Casella Waste Systems Inc. (NASDAQ:CWST), Engility Holdings Inc (NYSE:EGL), and Hecla Mining Company (NYSE:HL). All of these stocks’ market caps are similar to WTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSIG | 22 | 140776 | 4 |

| CWST | 16 | 177698 | 1 |

| EGL | 17 | 61929 | 6 |

| HL | 11 | 17805 | -1 |

| Average | 16.5 | 99552 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $152 million in WTI’s case. BrightSphere Investment Group plc (NYSE:BSIG) is the most popular stock in this table. On the other hand Hecla Mining Company (NYSE:HL) is the least popular one with only 11 bullish hedge fund positions. W&T Offshore, Inc. (NYSE:WTI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BSIG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.