Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Westinghouse Air Brake Technologies Corporation (NYSE:WAB), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

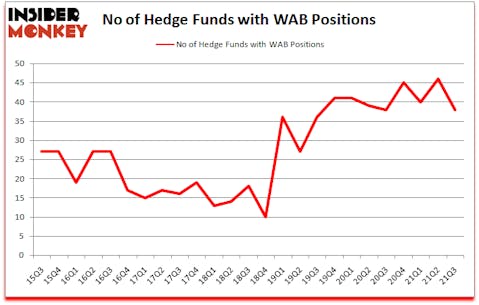

Westinghouse Air Brake Technologies Corporation (NYSE:WAB) has experienced a decrease in support from the world’s most elite money managers in recent months. Westinghouse Air Brake Technologies Corporation (NYSE:WAB) was in 38 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 46. Our calculations also showed that WAB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to check out the latest hedge fund action encompassing Westinghouse Air Brake Technologies Corporation (NYSE:WAB).

Paul Tudor Jones of Tudor Investment Corp

Do Hedge Funds Think WAB Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2021, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -17% from the previous quarter. By comparison, 38 hedge funds held shares or bullish call options in WAB a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Westinghouse Air Brake Technologies Corporation (NYSE:WAB), with a stake worth $878.3 million reported as of the end of September. Trailing Pzena Investment Management was Farallon Capital, which amassed a stake valued at $512.5 million. 3G Sahana Capital Management, XN Exponent Advisors, and Soroban Capital Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 3G Sahana Capital Management allocated the biggest weight to Westinghouse Air Brake Technologies Corporation (NYSE:WAB), around 29.27% of its 13F portfolio. XN Exponent Advisors is also relatively very bullish on the stock, dishing out 11.44 percent of its 13F equity portfolio to WAB.

Seeing as Westinghouse Air Brake Technologies Corporation (NYSE:WAB) has experienced a decline in interest from hedge fund managers, it’s easy to see that there exists a select few money managers who were dropping their entire stakes by the end of the third quarter. Interestingly, Kerr Neilson’s Platinum Asset Management dumped the biggest position of the 750 funds watched by Insider Monkey, worth about $105.7 million in stock. Clint Murray’s fund, Lodge Hill Capital, also cut its stock, about $10.7 million worth. These transactions are important to note, as total hedge fund interest dropped by 8 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Westinghouse Air Brake Technologies Corporation (NYSE:WAB). These stocks are Conagra Brands, Inc. (NYSE:CAG), Coupa Software Incorporated (NASDAQ:COUP), GoodRx Holdings, Inc. (NASDAQ:GDRX), 10x Genomics, Inc. (NASDAQ:TXG), MarketAxess Holdings Inc. (NASDAQ:MKTX), DLocal Limited (NASDAQ:DLO), and Repligen Corporation (NASDAQ:RGEN). This group of stocks’ market values resemble WAB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAG | 20 | 625323 | -9 |

| COUP | 52 | 4542300 | -2 |

| GDRX | 26 | 1063016 | -2 |

| TXG | 28 | 963031 | 0 |

| MKTX | 29 | 730008 | -2 |

| DLO | 19 | 480501 | 19 |

| RGEN | 35 | 1499835 | 0 |

| Average | 29.9 | 1414859 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.9 hedge funds with bullish positions and the average amount invested in these stocks was $1415 million. That figure was $2982 million in WAB’s case. Coupa Software Incorporated (NASDAQ:COUP) is the most popular stock in this table. On the other hand DLocal Limited (NASDAQ:DLO) is the least popular one with only 19 bullish hedge fund positions. Westinghouse Air Brake Technologies Corporation (NYSE:WAB) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for WAB is 50.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and beat the market again by 5.6 percentage points. Unfortunately WAB wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on WAB were disappointed as the stock returned 3.1% since the end of September (through 11/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Westinghouse Air Brake Technologies Corp (NYSE:WAB)

Follow Westinghouse Air Brake Technologies Corp (NYSE:WAB)

Receive real-time insider trading and news alerts

Suggested Articles:

- Michael Burry is Shorting Tesla and Buying These 10 Stocks Instead

- 12 Best Infrastructure Stocks To Buy Now

- Billionaire Andreas Halvorsen’s Top Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.