How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Wayfair Inc (NYSE:W).

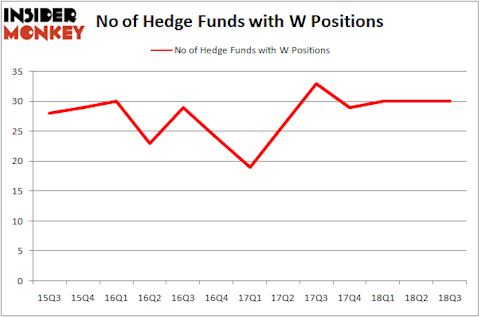

Wayfair Inc (NYSE:W) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 30 hedge funds’ portfolios at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Garmin Ltd. (NASDAQ:GRMN), Symantec Corporation (NASDAQ:SYMC), and Old Dominion Freight Line, Inc. (NASDAQ:ODFL) to gather more data points.

At the moment there are a multitude of signals stock traders use to analyze their holdings. Two of the most useful signals are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass their index-focused peers by a solid margin (see the details here).

We’re going to take a glance at the recent hedge fund action regarding Wayfair Inc (NYSE:W).

What does the smart money think about Wayfair Inc (NYSE:W)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, representing no change from the previous quarter. On the other hand, there were a total of 29 hedge funds with a bullish position in W at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, D E Shaw held the most valuable stake in Wayfair Inc (NYSE:W), which was worth $239 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $226.8 million worth of shares. Moreover, Light Street Capital, Two Sigma Advisors, and Adage Capital Management were also bullish on Wayfair Inc (NYSE:W), allocating a large percentage of their portfolios to this stock.

Seeing as Wayfair Inc (NYSE:W) has witnessed a decline in interest from the entirety of the hedge funds we track, we can see that there is a sect of hedgies that decided to sell off their positions entirely in the third quarter. Intriguingly, Howard Marks’s Oaktree Capital Management cut the largest position of the “upper crust” of funds tracked by Insider Monkey, valued at about $18.7 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund said goodbye to about $11.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Wayfair Inc (NYSE:W). We will take a look at Garmin Ltd. (NASDAQ:GRMN), Symantec Corporation (NASDAQ:SYMC), Old Dominion Freight Line, Inc. (NASDAQ:ODFL), and AEGON N.V. (NYSE:AEG). All of these stocks’ market caps are similar to W’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GRMN | 27 | 306746 | 2 |

| SYMC | 33 | 1466884 | 8 |

| ODFL | 24 | 253269 | 4 |

| AEG | 7 | 45622 | 3 |

| Average | 22.75 | 518130 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $518 million. That figure was $1.55 billion in W’s case. Symantec Corporation (NASDAQ:SYMC) is the most popular stock in this table. On the other hand AEGON N.V. (NYSE:AEG) is the least popular one with only 7 bullish hedge fund positions. Wayfair Inc (NYSE:W) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SYMC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.