Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

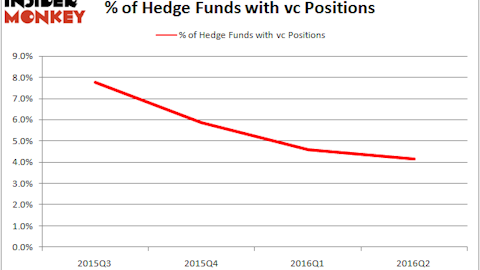

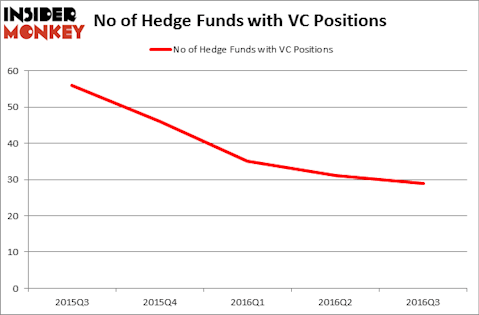

Visteon Corp (NYSE:VC) investors should pay attention to a decrease in hedge fund sentiment lately. At the end of this article we will also compare VC to other stocks including Laredo Petroleum Inc (NYSE:LPI), InterOil Corporation (USA) (NYSE:IOC), and Eastgroup Properties Inc (NYSE:EGP) to get a better sense of its popularity.

Follow Visteon Corp (NASDAQ:VC)

Follow Visteon Corp (NASDAQ:VC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Baloncici/Shutterstock.com

Keeping this in mind, we’re going to view the latest action regarding Visteon Corp (NYSE:VC).

What does the smart money think about Visteon Corp (NYSE:VC)?

Heading into the fourth quarter of 2016, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, down 6% from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Iridian Asset Management, run by David Cohen and Harold Levy, holds the number one position in Visteon Corp (NYSE:VC). According to regulatory filings, the fund has a $220.1 million position in the stock, comprising 1.9% of its 13F portfolio. The second most bullish fund manager is Solus Alternative Asset Management, led by Christopher Pucillo, holding an $87.6 million position; 24.4% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism contain Cliff Asness’ AQR Capital Management, D. E. Shaw’s D E Shaw and Gregg J. Powers’ Private Capital Management.