Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first quarter, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first quarter still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Vishay Precision Group Inc (NYSE:VPG) changed recently.

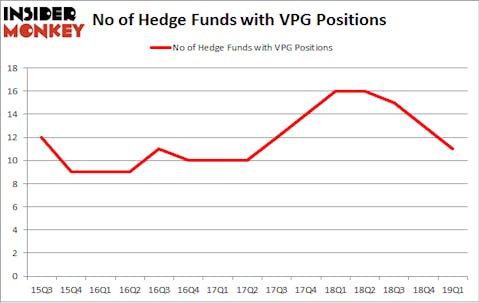

Vishay Precision Group Inc (NYSE:VPG) shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that VPG isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the latest hedge fund action encompassing Vishay Precision Group Inc (NYSE:VPG).

What have hedge funds been doing with Vishay Precision Group Inc (NYSE:VPG)?

At Q1’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in VPG a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in Vishay Precision Group Inc (NYSE:VPG) was held by Nokomis Capital, which reported holding $66.5 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $24.3 million position. Other investors bullish on the company included Royce & Associates, Harvey Partners, and D E Shaw.

Because Vishay Precision Group Inc (NYSE:VPG) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of funds who were dropping their positions entirely heading into Q3. Intriguingly, Thomas Bailard’s Bailard Inc dropped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, valued at about $0.4 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also dropped its stock, about $0.1 million worth. These moves are important to note, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Vishay Precision Group Inc (NYSE:VPG). We will take a look at Waterstone Financial, Inc. (NASDAQ:WSBF), Translate Bio, Inc. (NASDAQ:TBIO), Azure Power Global Limited (NYSE:AZRE), and DBV Technologies S.A. (NASDAQ:DBVT). This group of stocks’ market caps match VPG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WSBF | 11 | 76446 | 2 |

| TBIO | 7 | 88688 | 0 |

| AZRE | 6 | 6684 | 0 |

| DBVT | 8 | 76647 | 3 |

| Average | 8 | 62116 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $62 million. That figure was $129 million in VPG’s case. Waterstone Financial, Inc. (NASDAQ:WSBF) is the most popular stock in this table. On the other hand Azure Power Global Limited (NYSE:AZRE) is the least popular one with only 6 bullish hedge fund positions. Vishay Precision Group Inc (NYSE:VPG) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on VPG as the stock returned 13% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.