“Value has performed relatively poorly since the 2017 shift, but we believe challenges to the S&P 500’s dominance are mounting and resulting active opportunities away from the index are growing. At some point, this fault line will break, likely on the back of rising rates, and all investors will be reminded that the best time to diversify away from the winners is when it is most painful. The bargain of capturing long-term value may be short-term pain, but enough is eventually enough and it comes time to harvest the benefits.,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on ViewRay, Inc. (NASDAQ:VRAY) in order to identify whether reputable and successful top money managers continue to believe in its potential.

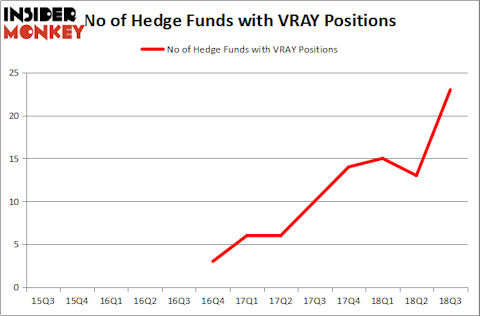

Is ViewRay, Inc. (NASDAQ:VRAY) the right pick for your portfolio? The best stock pickers are becoming hopeful. The number of long hedge fund bets improved by 10 recently. Our calculations also showed that VRAY isn’t among the 30 most popular stocks among hedge funds. VRAY was in 23 hedge funds’ portfolios at the end of the third quarter of 2018. There were 13 hedge funds in our database with VRAY holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action regarding ViewRay, Inc. (NASDAQ:VRAY).

How are hedge funds trading ViewRay, Inc. (NASDAQ:VRAY)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 77% from the previous quarter. The graph below displays the number of hedge funds with bullish position in VRAY over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Puissance Capital Managementá was the largest shareholder of ViewRay, Inc. (NASDAQ:VRAY), with a stake worth $64.1 million reported as of the end of September. Trailing Puissance Capital Managementá was OrbiMed Advisors, which amassed a stake valued at $53.7 million. Park West Asset Management, Millennium Management, and Perceptive Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were breaking ground themselves. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, created the most valuable position in ViewRay, Inc. (NASDAQ:VRAY). Healthcor Management LP had $23.6 million invested in the company at the end of the quarter. Christopher James’s Partner Fund Management also initiated a $8.2 million position during the quarter. The other funds with new positions in the stock are Phill Gross and Robert Atchinson’s Adage Capital Management, Chuck Royce’s Royce & Associates, and Kevin Kotler’s Broadfin Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ViewRay, Inc. (NASDAQ:VRAY) but similarly valued. We will take a look at Intersect ENT Inc (NASDAQ:XENT), Resolute Energy Corp (NYSE:REN), iShares India 50 ETF (NASDAQ:INDY), and Tahoe Resources Inc (NYSE:TAHO). This group of stocks’ market valuations match VRAY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XENT | 22 | 214135 | 1 |

| REN | 10 | 209903 | -4 |

| INDY | 2 | 11294 | 2 |

| TAHO | 13 | 32797 | -2 |

| Average | 11.75 | 117032 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $117 million. That figure was $323 million in VRAY’s case. Intersect ENT Inc (NASDAQ:XENT) is the most popular stock in this table. On the other hand 0 is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks ViewRay, Inc. (NASDAQ:VRAY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.