At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

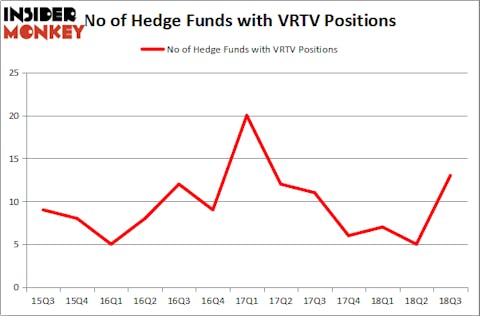

Is Veritiv Corp (NYSE:VRTV) the right pick for your portfolio? Prominent investors are becoming hopeful. The number of long hedge fund bets went up by 8 in recent months. Our calculations also showed that VRTV isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of signals stock market investors have at their disposal to grade publicly traded companies. Some of the best signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite money managers can outpace the S&P 500 by a healthy margin (see the details here).

Let’s take a glance at the fresh hedge fund action encompassing Veritiv Corp (NYSE:VRTV).

How have hedgies been trading Veritiv Corp (NYSE:VRTV)?

Heading into the fourth quarter of 2018, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 160% from the previous quarter. By comparison, 6 hedge funds held shares or bullish call options in VRTV heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Baupost Group held the most valuable stake in Veritiv Corp (NYSE:VRTV), which was worth $129.7 million at the end of the third quarter. On the second spot was Laurion Capital Management which amassed $18.1 million worth of shares. Moreover, Key Square Capital Management, Soros Fund Management, and Moore Global Investments were also bullish on Veritiv Corp (NYSE:VRTV), allocating a large percentage of their portfolios to this stock.

Consequently, some big names have jumped into Veritiv Corp (NYSE:VRTV) headfirst. Laurion Capital Management, managed by Benjamin A. Smith, created the most valuable position in Veritiv Corp (NYSE:VRTV). Laurion Capital Management had $18.1 million invested in the company at the end of the quarter. Scott Bessent’s Key Square Capital Management also initiated a $7.3 million position during the quarter. The following funds were also among the new VRTV investors: George Soros’s Soros Fund Management, Louis Bacon’s Moore Global Investments, and John W. Moon’s Moon Capital.

Let’s also examine hedge fund activity in other stocks similar to Veritiv Corp (NYSE:VRTV). We will take a look at Lantheus Holdings Inc (NASDAQ:LNTH), Independent Bank Corporation (NASDAQ:IBCP), Biglari Holdings Inc (NYSE:BH), and TETRA Technologies, Inc. (NYSE:TTI). All of these stocks’ market caps are closest to VRTV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNTH | 16 | 64553 | -1 |

| IBCP | 10 | 67693 | 0 |

| BH | 7 | 43738 | 0 |

| TTI | 18 | 28620 | 4 |

| Average | 12.75 | 51151 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $167 million in VRTV’s case. TETRA Technologies, Inc. (NYSE:TTI) is the most popular stock in this table. On the other hand Biglari Holdings Inc (NYSE:BH) is the least popular one with only 7 bullish hedge fund positions. Veritiv Corp (NYSE:VRTV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TTI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.