The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Universal Health Services, Inc. (NYSE:UHS).

Universal Health Services, Inc. (NYSE:UHS) investors should be aware of a decrease in hedge fund interest recently. At the end of this article we will also compare UHS to other stocks including Ameren Corp (NYSE:AEE), Perrigo Company (NASDAQ:PRGO), and Fidelity National Financial Inc (NYSE:FNF) to get a better sense of its popularity.

Follow Universal Health Services Inc (NYSE:UHS)

Follow Universal Health Services Inc (NYSE:UHS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Syda Productions/Shutterstock.com

Keeping this in mind, we’re going to take a peek at the key action regarding Universal Health Services, Inc. (NYSE:UHS).

What does the smart money think about Universal Health Services, Inc. (NYSE:UHS)?

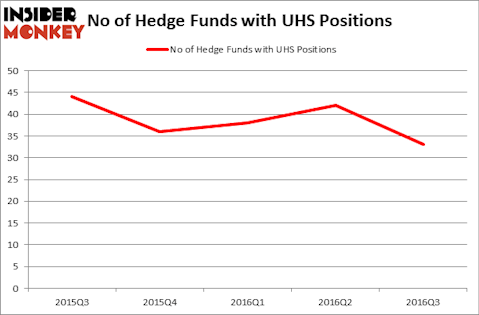

The number of funds tracked by Insider Monkey bullish on Universal Health Services declined by 21% to 33 during the third quarter. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Lee Ainslie’s Maverick Capital has the number one position in Universal Health Services, Inc. (NYSE:UHS), worth close to $564.9 million, accounting for 6.7% of its total 13F portfolio. Sitting at the No. 2 spot is Viking Global, led by Andreas Halvorsen, holding a $237.7 million position; 1% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that hold long positions consist of Barry Rosenstein’s JANA Partners, Larry Robbins’s Glenview Capital, and Cliff Asness’ AQR Capital Management.

Since Universal Health Services, Inc. (NYSE:UHS) has witnessed bearish sentiment from the smart money, it’s easy to see that there is a sect of fund managers that elected to cut their positions entirely last quarter. Intriguingly, Israel Englander’s Millennium Management said goodbye to the biggest position of all the hedgies monitored by Insider Monkey, valued at about $63.1 million in stock. Christopher James’s fund, Partner Fund Management, also sold off its stock, valued at about $33.5 million.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Universal Health Services, Inc. (NYSE:UHS) but similarly valued. We will take a look at Ameren Corp (NYSE:AEE), Perrigo Company (NASDAQ:PRGO), Fidelity National Financial Inc (NYSE:FNF), and CMS Energy Corporation (NYSE:CMS). This group of stocks’ market values are similar to UHS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AEE | 12 | 432193 | -3 |

| PRGO | 30 | 1620457 | 2 |

| FNF | 37 | 1124880 | -2 |

| CMS | 19 | 395362 | 1 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $893 million. That figure was $1.64 million in UHS’s case. Fidelity National Financial Inc (NYSE:FNF) is the most popular stock in this table, while Ameren Corp (NYSE:AEE) is the least popular one with only 12 bullish hedge fund positions. Universal Health Services, Inc. (NYSE:UHS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, Fidelity National Financial Inc (NYSE:FNF) might be a better candidate to consider a long position.