The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Universal Display Corporation (NASDAQ:OLED) from the perspective of those successful funds.

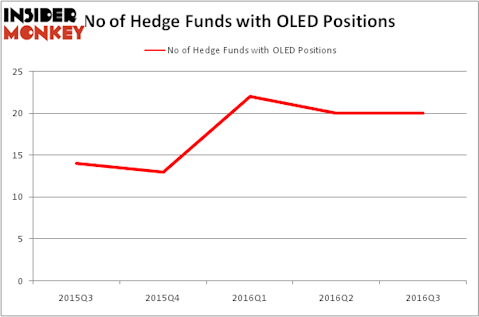

Universal Display Corporation (NASDAQ:OLED) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 20 hedge funds’ portfolios at the end of September, same as at the end of June. At the end of this article we will also compare OLED to other stocks including PNM Resources, Inc. (NYSE:PNM), WESCO International, Inc. (NYSE:WCC), and Nice Systems Ltd (ADR) (NASDAQ:NICE) to get a better sense of its popularity.

Follow Universal Display Corp (NASDAQ:OLED)

Follow Universal Display Corp (NASDAQ:OLED)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

How have hedgies been trading Universal Display Corporation (NASDAQ:OLED)?

Heading into the fourth quarter of 2016, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the second quarter of 2016. By comparison, 13 hedge funds held shares or bullish call options in OLED heading into this year, so hedge fund ownership of the stock is up be over 50% in 2016. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Columbus Circle Investors holds the biggest position in Universal Display Corporation (NASDAQ:OLED). Columbus Circle Investors has a $49.5 million position in the stock. The second most bullish fund manager is Polar Capital, led by Brian Ashford-Russell and Tim Woolley, which holds a $19.1 million position. Other professional money managers that are bullish encompass Christopher Zepf and Brian Thonn’s Kingdom Ridge Capital and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Universal Display Corporation (NASDAQ:OLED) has encountered bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedge funds who sold off their entire stakes heading into Q4. It’s worth mentioning that Rob Citrone’s Discovery Capital Management cashed in the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling close to $16.4 million in stock, and Kingdom Ridge Capital was right behind this move, as the fund sold off about $13.6 million worth of call options underlying OLED shares, while retaining its long position in the stock.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Universal Display Corporation (NASDAQ:OLED) but similarly valued. We will take a look at PNM Resources, Inc. (NYSE:PNM), WESCO International, Inc. (NYSE:WCC), Nice Systems Ltd (ADR) (NASDAQ:NICE), and Hawaiian Holdings, Inc. (NASDAQ:HA). This group of stocks’ market values resemble OLED’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNM | 13 | 161561 | 3 |

| WCC | 22 | 119988 | 0 |

| NICE | 14 | 169988 | 1 |

| HA | 24 | 225910 | 2 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $169 million. That figure was $122 million in OLED’s case. Hawaiian Holdings, Inc. (NASDAQ:HA) is the most popular stock in this table. On the other hand PNM Resources, Inc. (NYSE:PNM) is the least popular one with only 13 bullish hedge fund positions. Universal Display Corporation (NASDAQ:OLED) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HA might be a better candidate to consider taking a long position in.

Disclosure: None