Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

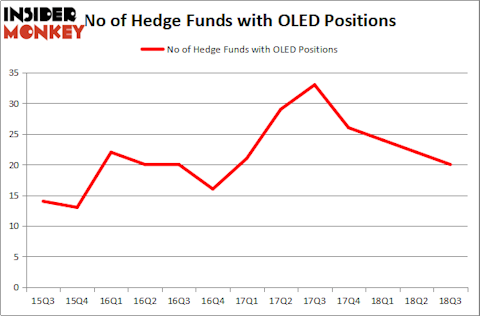

Universal Display Corporation (NASDAQ:OLED) has experienced a decrease in activity from the world’s largest hedge funds in recent months. OLED was in 20 hedge funds’ portfolios at the end of the third quarter of 2018. There were 22 hedge funds in our database with OLED positions at the end of the previous quarter. Our calculations also showed that OLED isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the new hedge fund action encompassing Universal Display Corporation (NASDAQ:OLED).

What does the smart money think about Universal Display Corporation (NASDAQ:OLED)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the second quarter of 2018. On the other hand, there were a total of 26 hedge funds with a bullish position in OLED at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Universal Display Corporation (NASDAQ:OLED) was held by Millennium Management, which reported holding $50.4 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $38 million position. Other investors bullish on the company included Light Street Capital, PEAK6 Capital Management, and Polar Capital.

Seeing as Universal Display Corporation (NASDAQ:OLED) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there were a few money managers that elected to cut their positions entirely by the end of the third quarter. Interestingly, Jim Simons’s Renaissance Technologies dropped the largest investment of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $18.9 million in stock. Steve Pei’s fund, Gratia Capital, also sold off its stock, about $6.3 million worth. These bearish behaviors are important to note, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Universal Display Corporation (NASDAQ:OLED) but similarly valued. We will take a look at Wyndham Hotels & Resorts, Inc. (NYSE:WH), The Goodyear Tire & Rubber Company (NASDAQ:GT), Healthcare Trust Of America Inc (NYSE:HTA), and Sonoco Products Company (NYSE:SON). This group of stocks’ market valuations resemble OLED’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WH | 39 | 991793 | 5 |

| GT | 25 | 654247 | 3 |

| HTA | 16 | 321403 | 1 |

| SON | 23 | 93175 | 3 |

| Average | 25.75 | 515155 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $515 million. That figure was $192 million in OLED’s case. Wyndham Hotels & Resorts, Inc. (NYSE:WH) is the most popular stock in this table. On the other hand Healthcare Trust Of America Inc (NYSE:HTA) is the least popular one with only 16 bullish hedge fund positions. Universal Display Corporation (NASDAQ:OLED) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WH might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.