The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Trinity Merger Corp. (NASDAQ:TMCX).

Is Trinity Merger Corp. (NASDAQ:TMCX) a buy right now? The best stock pickers are betting on the stock. The number of bullish hedge fund positions advanced by 2 recently. Our calculations also showed that TMCX isn’t among the 30 most popular stocks among hedge funds.

Today there are several metrics shareholders employ to appraise stocks. Some of the best metrics are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top fund managers can trounce the market by a superb margin (see the details here).

We’re going to view the latest hedge fund action encompassing Trinity Merger Corp. (NASDAQ:TMCX).

How are hedge funds trading Trinity Merger Corp. (NASDAQ:TMCX)?

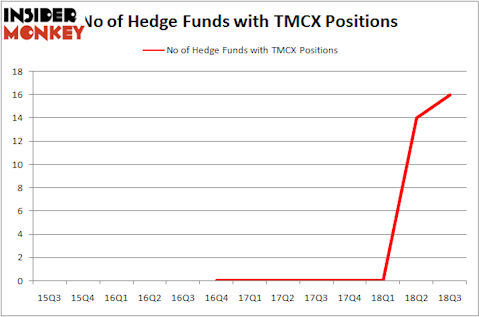

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TMCX over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Glazer Capital, managed by Paul Glazer, holds the most valuable position in Trinity Merger Corp. (NASDAQ:TMCX). Glazer Capital has a $18 million position in the stock, comprising 1.9% of its 13F portfolio. Sitting at the No. 2 spot is Israel Englander of Millennium Management, with a $9.8 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions encompass Andrew Weiss’s Weiss Asset Management, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Sander Gerber’s Hudson Bay Capital Management.

Consequently, key hedge funds were leading the bulls’ herd. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, initiated the most outsized position in Trinity Merger Corp. (NASDAQ:TMCX). BlueCrest Capital Mgmt. had $4.4 million invested in the company at the end of the quarter. Jeffrey Altman’s Owl Creek Asset Management also initiated a $3.4 million position during the quarter. The other funds with brand new TMCX positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ari Zweiman’s 683 Capital Partners, and James Dondero’s Highland Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Trinity Merger Corp. (NASDAQ:TMCX) but similarly valued. These stocks are Barnes & Noble, Inc. (NYSE:BKS), Farmers National Banc Corp (NASDAQ:FMNB), Nautilus, Inc. (NYSE:NLS), and Pimco Income Opportunity Fund (NYSE:PKO). This group of stocks’ market caps match TMCX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BKS | 16 | 17313 | 4 |

| FMNB | 6 | 13054 | 1 |

| NLS | 16 | 53191 | 1 |

| PKO | 1 | 3176 | -1 |

| Average | 9.75 | 21684 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $22 million. That figure was $68 million in TMCX’s case. Barnes & Noble, Inc. (NYSE:BKS) is the most popular stock in this table. On the other hand Pimco Income Opportunity Fund (NYSE:PKO) is the least popular one with only 1 bullish hedge fund positions. Trinity Merger Corp. (NASDAQ:TMCX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BKS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.