Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Trinity Industries, Inc. (NYSE:TRN).

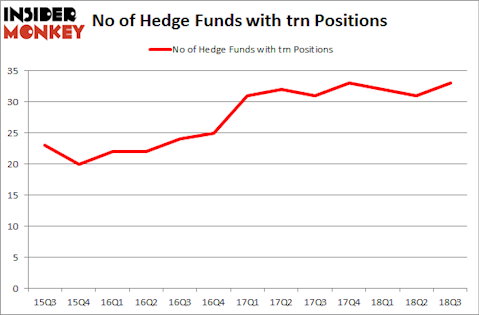

Is Trinity Industries, Inc. (NYSE:TRN) a buy, sell, or hold? The best stock pickers are in an optimistic mood. The number of long hedge fund positions rose by 2 in recent months. Our calculations also showed that trn isn’t among the 30 most popular stocks among hedge funds. TRN was in 33 hedge funds’ portfolios at the end of September. There were 31 hedge funds in our database with TRN positions at the end of the previous quarter.

To the average investor there are a large number of indicators investors can use to grade publicly traded companies. Two of the less utilized indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best money managers can trounce the S&P 500 by a solid margin (see the details here).

We’re going to review the new hedge fund action regarding Trinity Industries, Inc. (NYSE:TRN).

How are hedge funds trading Trinity Industries, Inc. (NYSE:TRN)?

At the end of the third quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. By comparison, 33 hedge funds held shares or bullish call options in TRN heading into this year. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, ValueAct Capital was the largest shareholder of Trinity Industries, Inc. (NYSE:TRN), with a stake worth $784.4 million reported as of the end of September. Trailing ValueAct Capital was Omega Advisors, which amassed a stake valued at $65.7 million. Millennium Management, Citadel Investment Group, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most valuable position in Trinity Industries, Inc. (NYSE:TRN). Arrowstreet Capital had $23.3 million invested in the company at the end of the quarter. Amy Minella’s Cardinal Capital also made a $22.2 million investment in the stock during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, Sara Nainzadeh’s Centenus Global Management, and Ilya Boroditsky’s Precision Path Capital.

Let’s check out hedge fund activity in other stocks similar to Trinity Industries, Inc. (NYSE:TRN). These stocks are Mattel, Inc. (NASDAQ:MAT), United States Steel Corporation (NYSE:X), First Citizens BancShares Inc. (NASDAQ:FCNCA), and RenaissanceRe Holdings Ltd. (NYSE:RNR). All of these stocks’ market caps resemble TRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAT | 16 | 838039 | 2 |

| X | 32 | 636345 | 2 |

| FCNCA | 19 | 258819 | -1 |

| RNR | 20 | 478444 | 4 |

| Average | 21.75 | 552912 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $553 million. That figure was $1.28 billion in TRN’s case. United States Steel Corporation (NYSE:X) is the most popular stock in this table. On the other hand Mattel, Inc. (NASDAQ:MAT) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Trinity Industries, Inc. (NYSE:TRN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.