It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 30 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 15.1% over the last 12 months (vs. 5.6% gain for SPY), with 53% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in TriCo Bancshares (NASDAQ:TCBK).

TriCo Bancshares (NASDAQ:TCBK) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Weis Markets, Inc. (NYSE:WMK), Astec Industries, Inc. (NASDAQ:ASTE), and CorePoint Lodging Inc. (NYSE:CPLG) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

We’re going to take a look at the fresh hedge fund action surrounding TriCo Bancshares (NASDAQ:TCBK).

How are hedge funds trading TriCo Bancshares (NASDAQ:TCBK)?

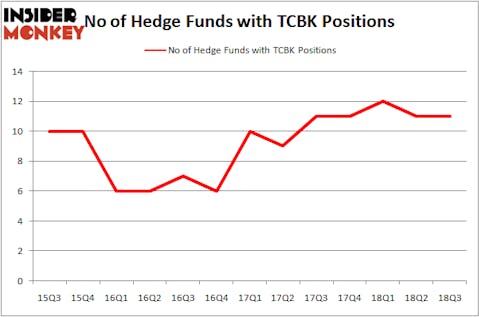

Heading into the fourth quarter of 2018, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TCBK over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in TriCo Bancshares (NASDAQ:TCBK), which was worth $22.5 million at the end of the third quarter. On the second spot was Castine Capital Management which amassed $8.6 million worth of shares. Moreover, Basswood Capital, AQR Capital Management, and Two Sigma Advisors were also bullish on TriCo Bancshares (NASDAQ:TCBK), allocating a large percentage of their portfolios to this stock.

Because TriCo Bancshares (NASDAQ:TCBK) has witnessed falling interest from the smart money, it’s safe to say that there was a specific group of funds who sold off their full holdings last quarter. At the top of the heap, Israel Englander’s Millennium Management dumped the biggest position of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $4.2 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund sold off about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as TriCo Bancshares (NASDAQ:TCBK) but similarly valued. We will take a look at Weis Markets, Inc. (NYSE:WMK), Astec Industries, Inc. (NASDAQ:ASTE), CorePoint Lodging Inc. (NYSE:CPLG), and Hannon Armstrong Sustnbl Infrstr Cap Inc (NYSE:HASI). All of these stocks’ market caps are similar to TCBK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMK | 15 | 89216 | 1 |

| ASTE | 10 | 126988 | 3 |

| CPLG | 23 | 239001 | 3 |

| HASI | 6 | 16321 | 0 |

| Average | 13.5 | 117882 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $118 million. That figure was $47 million in TCBK’s case. CorePoint Lodging Inc. (NYSE:CPLG) is the most popular stock in this table. On the other hand Hannon Armstrong Sustnbl Infrstr Cap Inc (NYSE:HASI) is the least popular one with only 6 bullish hedge fund positions. TriCo Bancshares (NASDAQ:TCBK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CPLG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.