At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards The Timken Company (NYSE:TKR).

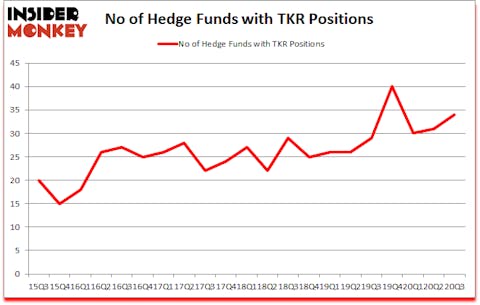

Is TKR a good stock to buy? The Timken Company (NYSE:TKR) shareholders have witnessed an increase in hedge fund interest lately. The Timken Company (NYSE:TKR) was in 34 hedge funds’ portfolios at the end of September. The all time high for this statistic is 40. Our calculations also showed that TKR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most shareholders, hedge funds are perceived as worthless, old financial tools of years past. While there are more than 8000 funds with their doors open at present, We hone in on the top tier of this group, around 850 funds. These investment experts preside over bulk of the hedge fund industry’s total asset base, and by observing their top stock picks, Insider Monkey has determined a few investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Louis Bacon Moore of Moore Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a gander at the fresh hedge fund action encompassing The Timken Company (NYSE:TKR).

Do Hedge Funds Think TKR Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in TKR over the last 21 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in The Timken Company (NYSE:TKR). AQR Capital Management has a $55.1 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Adage Capital Management, led by Phill Gross and Robert Atchinson, holding a $53.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Principal Global Investors’s Columbus Circle Investors and Alexander Mitchell’s Scopus Asset Management. In terms of the portfolio weights assigned to each position Columbus Circle Investors allocated the biggest weight to The Timken Company (NYSE:TKR), around 1.08% of its 13F portfolio. Beddow Capital Management is also relatively very bullish on the stock, dishing out 0.77 percent of its 13F equity portfolio to TKR.

Consequently, some big names have jumped into The Timken Company (NYSE:TKR) headfirst. Moore Global Investments, managed by Louis Bacon, created the most valuable position in The Timken Company (NYSE:TKR). Moore Global Investments had $12.9 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $0.8 million position during the quarter. The following funds were also among the new TKR investors: Renee Yao’s Neo Ivy Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Hoon Kim’s Quantinno Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Timken Company (NYSE:TKR) but similarly valued. These stocks are Mattel, Inc. (NASDAQ:MAT), Companhia Siderurgica Nacional (NYSE:SID), Acuity Brands, Inc. (NYSE:AYI), Virgin Galactic Holdings, Inc. (NYSE:SPCE), Wingstop Inc (NASDAQ:WING), Medallia, Inc. (NYSE:MDLA), and IDACORP Inc (NYSE:IDA). This group of stocks’ market caps resemble TKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAT | 26 | 724311 | 1 |

| SID | 7 | 35104 | 0 |

| AYI | 38 | 836103 | 0 |

| SPCE | 24 | 76924 | 2 |

| WING | 32 | 365263 | 4 |

| MDLA | 24 | 382834 | 6 |

| IDA | 31 | 227986 | 9 |

| Average | 26 | 378361 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $378 million. That figure was $240 million in TKR’s case. Acuity Brands, Inc. (NYSE:AYI) is the most popular stock in this table. On the other hand Companhia Siderurgica Nacional (NYSE:SID) is the least popular one with only 7 bullish hedge fund positions. The Timken Company (NYSE:TKR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for TKR is 77. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and still beat the market by 16.4 percentage points. Hedge funds were also right about betting on TKR as the stock returned 42.5% since the end of Q3 (through 12/18) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Timken Co (NYSE:TKR)

Follow Timken Co (NYSE:TKR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.