Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like The Valspar Corp (NYSE:VAL).

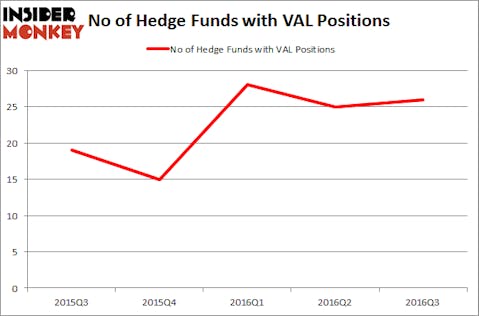

The Valspar Corp (NYSE:VAL) has seen an increase in hedge fund interest of late. 26 hedge funds that we track were long the stock on September 30. There were 25 hedge funds in our database with VAL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Valeant Pharmaceuticals Intl Inc (NYSE:VRX), Brixmor Property Group Inc (NYSE:BRX), and Lululemon Athletica inc. (NASDAQ:LULU) to gather more data points.

Follow Valspar Corp (NYSE:VAL)

Follow Valspar Corp (NYSE:VAL)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Verlen4418/Shutterstock.com

What does the smart money think about The Valspar Corp (NYSE:VAL)?

Heading into the fourth quarter of 2016, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a 4% increase from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in VAL over the last 5 quarters, which has risen sharply in 2016. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Magnetar Capital, led by Alec Litowitz and Ross Laser, holds the most valuable position in The Valspar Corp (NYSE:VAL). Magnetar Capital has a $108.5 million position in the stock, comprising 1.7% of its 13F portfolio. Sitting at the No. 2 spot is Alpine Associates, led by Robert Emil Zoellner, holding an $86.4 million position; 3.2% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism comprise Mark Wolfson and Jamie Alexander’s Jasper Ridge Partners, Mario Gabelli’s GAMCO Investors, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.