The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards The Progressive Corporation (NYSE:PGR).

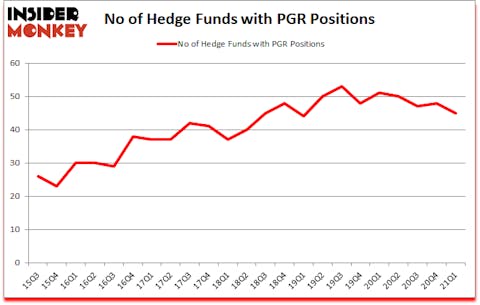

Is PGR a good stock to buy? The smart money was getting less bullish. The number of long hedge fund bets fell by 3 lately. The Progressive Corporation (NYSE:PGR) was in 45 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 53. Our calculations also showed that PGR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 48 hedge funds in our database with PGR positions at the end of the fourth quarter.

According to most traders, hedge funds are assumed to be slow, old financial tools of the past. While there are more than 8000 funds with their doors open today, Our researchers look at the upper echelon of this club, around 850 funds. It is estimated that this group of investors administer the majority of all hedge funds’ total capital, and by shadowing their matchless stock picks, Insider Monkey has revealed several investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation, which is why we are checking out this inflation play. We go through lists like 10 best gold stocks to buy to identify promising stocks. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a glance at the fresh hedge fund action encompassing The Progressive Corporation (NYSE:PGR).

Do Hedge Funds Think PGR Is A Good Stock To Buy Now?

At the end of the first quarter, a total of 45 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PGR over the last 23 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in The Progressive Corporation (NYSE:PGR) was held by Brave Warrior Capital, which reported holding $228.5 million worth of stock at the end of December. It was followed by AQR Capital Management with a $127.4 million position. Other investors bullish on the company included BloombergSen, Abrams Bison Investments, and GQG Partners. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to The Progressive Corporation (NYSE:PGR), around 7.94% of its 13F portfolio. Brave Warrior Capital is also relatively very bullish on the stock, designating 7.46 percent of its 13F equity portfolio to PGR.

Because The Progressive Corporation (NYSE:PGR) has experienced falling interest from the aggregate hedge fund industry, logic holds that there is a sect of fund managers who were dropping their entire stakes heading into Q2. At the top of the heap, John Armitage’s Egerton Capital Limited cut the biggest investment of the “upper crust” of funds monitored by Insider Monkey, totaling about $298.2 million in stock, and Andreas Halvorsen’s Viking Global was right behind this move, as the fund said goodbye to about $88.5 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds heading into Q2.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Progressive Corporation (NYSE:PGR) but similarly valued. We will take a look at Moody’s Corporation (NYSE:MCO), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), NXP Semiconductors NV (NASDAQ:NXPI), Prudential Public Limited Company (NYSE:PUK), Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR), Stellantis N.V. (NYSE:STLA), and ICICI Bank Limited (NYSE:IBN). This group of stocks’ market values match PGR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCO | 55 | 13726876 | -4 |

| VRTX | 68 | 3711731 | 15 |

| NXPI | 53 | 1718673 | -13 |

| PUK | 2 | 4640 | 0 |

| PBR | 27 | 878461 | 3 |

| STLA | 21 | 751799 | 6 |

| IBN | 31 | 1903240 | 2 |

| Average | 36.7 | 3242203 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.7 hedge funds with bullish positions and the average amount invested in these stocks was $3242 million. That figure was $1211 million in PGR’s case. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is the most popular stock in this table. On the other hand Prudential Public Limited Company (NYSE:PUK) is the least popular one with only 2 bullish hedge fund positions. The Progressive Corporation (NYSE:PGR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PGR is 60. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 17.4% in 2021 through June 18th and beat the market again by 6.1 percentage points. Unfortunately PGR wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on PGR were disappointed as the stock returned -3.4% since the end of March (through 6/18) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Progressive Corp (NYSE:PGR)

Follow Progressive Corp (NYSE:PGR)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 25 States With Highest Depression Rates

- Top 10 Cloud Computing Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.