Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards The GDL Fund (NYSE:GDL).

The GDL Fund (NYSE:GDL) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 3 hedge funds’ portfolios at the end of September. At the end of this article we will also compare GDL to other stocks including First Savings Financial Group, Inc. (NASDAQ:FSFG), LSB Industries, Inc. (NYSE:LXU), and Points International Ltd (NASDAQ:PCOM) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the key hedge fund action surrounding The GDL Fund (NYSE:GDL).

How are hedge funds trading The GDL Fund (NYSE:GDL)?

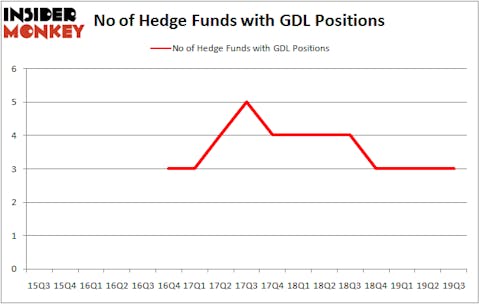

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GDL over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The GDL Fund (NYSE:GDL) was held by GAMCO Investors, which reported holding $3.3 million worth of stock at the end of September. It was followed by Ancora Advisors with a $1.7 million position. The only other hedge fund that is bullish on the company was Horizon Asset Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now take a look at hedge fund activity in other stocks similar to The GDL Fund (NYSE:GDL). These stocks are First Savings Financial Group, Inc. (NASDAQ:FSFG), LSB Industries, Inc. (NYSE:LXU), Points International Ltd (NASDAQ:PCOM), and Barnes & Noble Education Inc (NYSE:BNED). This group of stocks’ market valuations resemble GDL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSFG | 4 | 6140 | 1 |

| LXU | 5 | 10516 | -1 |

| PCOM | 6 | 11297 | 0 |

| BNED | 9 | 4523 | -7 |

| Average | 6 | 8119 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $8 million. That figure was $6 million in GDL’s case. Barnes & Noble Education Inc (NYSE:BNED) is the most popular stock in this table. On the other hand First Savings Financial Group, Inc. (NASDAQ:FSFG) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks The GDL Fund (NYSE:GDL) is even less popular than FSFG. Hedge funds dodged a bullet by taking a bearish stance towards GDL. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately GDL wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); GDL investors were disappointed as the stock returned 1.1% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.