Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The one and a half month time period since the end of the third quarter is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of The Buckle, Inc. (NYSE:BKE).

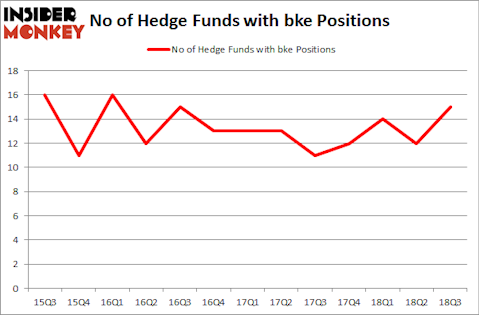

Is The Buckle, Inc. (NYSE:BKE) a buy right now? Hedge funds are buying. The number of bullish hedge fund positions improved by 3 lately. Our calculations also showed that bke isn’t among the 30 most popular stocks among hedge funds. BKE was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. There were 12 hedge funds in our database with BKE positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the key hedge fund action surrounding The Buckle, Inc. (NYSE:BKE).

How have hedgies been trading The Buckle, Inc. (NYSE:BKE)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in BKE at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in The Buckle, Inc. (NYSE:BKE), which was worth $5.8 million at the end of the third quarter. On the second spot was Sprott Asset Management which amassed $5.4 million worth of shares. Moreover, Ancora Advisors, Two Sigma Advisors, and AQR Capital Management were also bullish on The Buckle, Inc. (NYSE:BKE), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names have jumped into The Buckle, Inc. (NYSE:BKE) headfirst. Hudson Bay Capital Management, managed by Sander Gerber, established the most outsized position in The Buckle, Inc. (NYSE:BKE). Hudson Bay Capital Management had $2.2 million invested in the company at the end of the quarter. Paul Tudor Jones’s Tudor Investment Corp also initiated a $0.7 million position during the quarter. The other funds with brand new BKE positions are Jim Simons’s Renaissance Technologies, Israel Englander’s Millennium Management, and Elise Di Vincenzo Crumbine’s Stormborn Capital Management.

Let’s go over hedge fund activity in other stocks similar to The Buckle, Inc. (NYSE:BKE). We will take a look at Chase Corporation (NYSE:CCF), CTS Corporation (NYSE:CTS), Entercom Communications Corp. (NYSE:ETM), and Forum Energy Technologies Inc (NYSE:FET). All of these stocks’ market caps are similar to BKE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCF | 6 | 90698 | 1 |

| CTS | 10 | 112420 | 1 |

| ETM | 14 | 193471 | 2 |

| FET | 9 | 26899 | -1 |

| Average | 9.75 | 105872 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $30 million in BKE’s case. Entercom Communications Corp. (NYSE:ETM) is the most popular stock in this table. On the other hand Chase Corporation (NYSE:CCF) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks The Buckle, Inc. (NYSE:BKE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.