Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 8.7% through October 26th. Forty percent of the S&P 500 constituents were down more than 10%. The average return of a randomly picked stock in the index is -9.5%. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 25 most popular S&P 500 stocks among hedge funds had an average loss of 8.8%. In this article, we will take a look at what hedge funds think about The Boeing Company (NYSE:BA).

Hedge fund interest in The Boeing Company (NYSE:BA) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare BA to other stocks including The Procter & Gamble Company (NYSE:PG), China Mobile Limited (NYSE:CHL), and Novartis AG (NYSE:NVS) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to review the latest hedge fund action surrounding The Boeing Company (NYSE:BA).

How are hedge funds trading The Boeing Company (NYSE:BA)?

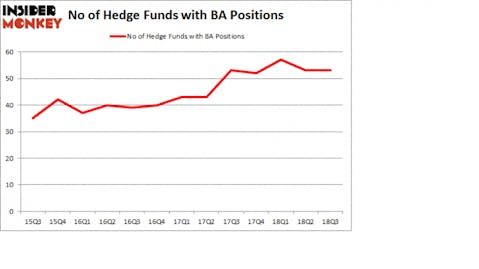

At Q3’s end, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from one quarter earlier. The graph below displays the number of hedge funds with bullish position in BA over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The Boeing Company (NYSE:BA) was held by AQR Capital Management, which reported holding $835.5 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $783.7 million position. Other investors bullish on the company included Senator Investment Group, Suvretta Capital Management, and Two Sigma Advisors.

Due to the fact that The Boeing Company (NYSE:BA) has experienced falling interest from hedge fund managers, it’s easy to see that there is a sect of money managers that decided to sell off their positions entirely by the end of the third quarter. Interestingly, Zach Schreiber’s Point State Capital said goodbye to the biggest stake of the 700 funds tracked by Insider Monkey, valued at about $97.3 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also dropped its stock, about $52.9 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to The Boeing Company (NYSE:BA). We will take a look at The Procter & Gamble Company (NYSE:PG), China Mobile Limited (NYSE:CHL), Novartis AG (NYSE:NVS), and The Coca-Cola Company (NYSE:KO). This group of stocks’ market valuations are similar to BA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PG | 53 | 8432523 | 9 |

| CHL | 15 | 407859 | 2 |

| NVS | 29 | 1726900 | 4 |

| KO | 43 | 20664284 | 4 |

| Average | 35 | 7807892 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $7.81 billion. That figure was $3.75 billion in BA’s case. The Procter & Gamble Company (NYSE:PG) is the most popular stock in this table. On the other hand China Mobile Limited (NYSE:CHL) is the least popular one with only 15 bullish hedge fund positions. The Boeing Company (NYSE:BA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.