“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Teradyne, Inc. (NASDAQ:TER) investors should pay attention to a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that ter isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the key hedge fund action encompassing Teradyne, Inc. (NASDAQ:TER).

How have hedgies been trading Teradyne, Inc. (NASDAQ:TER)?

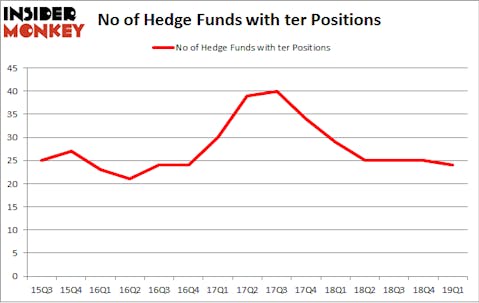

At the end of the first quarter, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards TER over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Teradyne, Inc. (NASDAQ:TER), with a stake worth $163.3 million reported as of the end of March. Trailing Renaissance Technologies was Alkeon Capital Management, which amassed a stake valued at $102 million. Two Sigma Advisors, Citadel Investment Group, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Teradyne, Inc. (NASDAQ:TER) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there exists a select few hedge funds who sold off their entire stakes heading into Q3. It’s worth mentioning that Chuck Royce’s Royce & Associates dropped the largest investment of the 700 funds watched by Insider Monkey, worth about $36.7 million in stock, and Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors was right behind this move, as the fund cut about $23.1 million worth. These transactions are important to note, as total hedge fund interest was cut by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Teradyne, Inc. (NASDAQ:TER) but similarly valued. These stocks are Alaska Air Group, Inc. (NYSE:ALK), Capri Holdings Limited (NYSE:CPRI), Douglas Emmett, Inc. (NYSE:DEI), and Nordstrom, Inc. (NYSE:JWN). All of these stocks’ market caps are closest to TER’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALK | 20 | 466021 | -12 |

| CPRI | 37 | 1222168 | 4 |

| DEI | 14 | 363321 | 2 |

| JWN | 26 | 283069 | 3 |

| Average | 24.25 | 583645 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $584 million. That figure was $564 million in TER’s case. Capri Holdings Limited (NYSE:CPRI) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 14 bullish hedge fund positions. Teradyne, Inc. (NASDAQ:TER) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on TER as the stock returned 7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.