Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about Tenaris SA (ADR) (NYSE:TS) in this article.

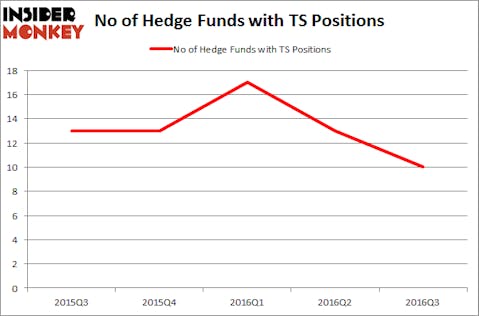

Tenaris SA (ADR) (NYSE:TS) has experienced a decrease in hedge fund sentiment recently. TS was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 13 hedge funds in our database with TS holdings at the end of the previous quarter. At the end of this article we will also compare TS to other stocks including Level 3 Communications, Inc. (NYSE:LVLT), Magna International Inc. (USA) (NYSE:MGA), and Western Digital Corp. (NASDAQ:WDC) to get a better sense of its popularity.

Follow Tenaris S A (NYSE:TS)

Follow Tenaris S A (NYSE:TS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Zorandim/Shutterstock.com

How are hedge funds trading Tenaris SA (ADR) (NYSE:TS)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 23% from the previous quarter. On the other hand, there were a total of 13 hedge funds with a bullish position in TS at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Carlson Capital, led by Clint Carlson, holds the biggest position in Tenaris SA (ADR) (NYSE:TS). Carlson Capital has a $63.4 million position in the stock. The second most bullish fund manager is Craig C. Albert of Sheffield Asset Management, with a $54.3 million position; the fund has 15.6% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group and John W. Rogers’ Ariel Investments. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually cut their positions entirely. At the top of the heap, John Burbank’s Passport Capital cut the biggest stake of the 700 funds followed by Insider Monkey, totaling about $10.8 million in stock. Charles Clough’s fund, Clough Capital Partners, also said goodbye to its stock, about $2.9 million worth.

Let’s go over hedge fund activity in other stocks similar to Tenaris SA (ADR) (NYSE:TS). We will take a look at Level 3 Communications, Inc. (NYSE:LVLT), Magna International Inc. (USA) (NYSE:MGA), Western Digital Corp. (NASDAQ:WDC), and T. Rowe Price Group, Inc. (NASDAQ:TROW). All of these stocks’ market caps are closest to TS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LVLT | 49 | 2788737 | 1 |

| MGA | 27 | 435061 | -2 |

| WDC | 51 | 1102808 | 3 |

| TROW | 28 | 534363 | 5 |

As you can see these stocks had an average of 39 hedge funds with bullish positions and the average amount invested in these stocks was $1.22 billion. That figure was $170 million in TS’s case. Western Digital Corp. (NASDAQ:WDC) is the most popular stock in this table. On the other hand Magna International Inc. (USA) (NYSE:MGA) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Tenaris SA (ADR) (NYSE:TS) is even less popular than MGA. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None