Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of SVB Financial Group (NASDAQ:SIVB) based on that data.

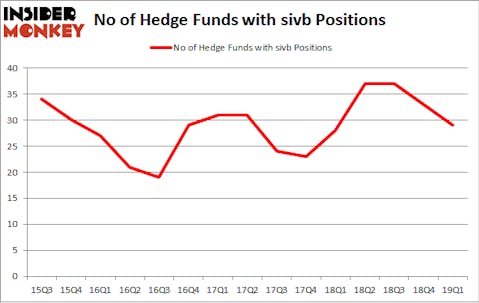

SVB Financial Group (NASDAQ:SIVB) was in 29 hedge funds’ portfolios at the end of March. SIVB shareholders have witnessed a decrease in hedge fund sentiment recently. There were 33 hedge funds in our database with SIVB holdings at the end of the previous quarter. Our calculations also showed that sivb isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s review the latest hedge fund action regarding SVB Financial Group (NASDAQ:SIVB).

Hedge fund activity in SVB Financial Group (NASDAQ:SIVB)

Heading into the second quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SIVB over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the most valuable position in SVB Financial Group (NASDAQ:SIVB). Fisher Asset Management has a $202 million position in the stock, comprising 0.3% of its 13F portfolio. On Fisher Asset Management’s heels is Columbus Circle Investors, managed by Principal Global Investors, which holds a $61.3 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish encompass Ric Dillon’s Diamond Hill Capital, Louis Bacon’s Moore Global Investments and Phill Gross and Robert Atchinson’s Adage Capital Management.

Judging by the fact that SVB Financial Group (NASDAQ:SIVB) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there were a few hedge funds that slashed their full holdings in the third quarter. It’s worth mentioning that Ken Griffin’s Citadel Investment Group dropped the biggest stake of the “upper crust” of funds followed by Insider Monkey, comprising about $89.9 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dumped its stock, about $11.2 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 4 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to SVB Financial Group (NASDAQ:SIVB). These stocks are Akamai Technologies, Inc. (NASDAQ:AKAM), Molson Coors Brewing Company (NYSE:TAP), Brookfield Infrastructure Partners L.P. (NYSE:BIP), and Comerica Incorporated (NYSE:CMA). All of these stocks’ market caps are closest to SIVB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AKAM | 28 | 763869 | -6 |

| TAP | 27 | 317583 | -1 |

| BIP | 7 | 28125 | -1 |

| CMA | 36 | 579378 | 0 |

| Average | 24.5 | 422239 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $552 million in SIVB’s case. Comerica Incorporated (NYSE:CMA) is the most popular stock in this table. On the other hand Brookfield Infrastructure Partners L.P. (NYSE:BIP) is the least popular one with only 7 bullish hedge fund positions. SVB Financial Group (NASDAQ:SIVB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SIVB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SIVB were disappointed as the stock returned -4.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.