Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Summit Hotel Properties Inc (NYSE:INN) to find out whether it was one of their high conviction long-term ideas.

Is Summit Hotel Properties Inc (NYSE:INN) a safe investment today? Money managers are becoming less confident. The number of long hedge fund positions retreated by 1 in recent months. Our calculations also showed that INN isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several formulas stock market investors put to use to appraise stocks. A pair of the most underrated formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can trounce the broader indices by a solid amount (see the details here).

James Dondero of Highland Capital Management

We’re going to take a glance at the new hedge fund action surrounding Summit Hotel Properties Inc (NYSE:INN).

How have hedgies been trading Summit Hotel Properties Inc (NYSE:INN)?

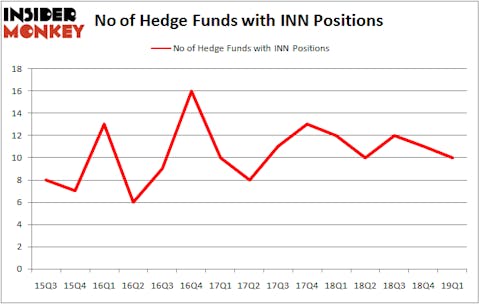

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards INN over the last 15 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in Summit Hotel Properties Inc (NYSE:INN) was held by Millennium Management, which reported holding $7.1 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $2.2 million position. Other investors bullish on the company included Two Sigma Advisors, Point72 Asset Management, and Highland Capital Management.

Judging by the fact that Summit Hotel Properties Inc (NYSE:INN) has witnessed falling interest from the aggregate hedge fund industry, it’s safe to say that there were a few hedge funds that elected to cut their entire stakes in the third quarter. Intriguingly, D. E. Shaw’s D E Shaw sold off the biggest investment of all the hedgies tracked by Insider Monkey, worth close to $0.7 million in stock, and Jeffrey Talpins’s Element Capital Management was right behind this move, as the fund cut about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 1 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Summit Hotel Properties Inc (NYSE:INN). These stocks are Encore Wire Corporation (NASDAQ:WIRE), TriCo Bancshares (NASDAQ:TCBK), Teekay LNG Partners L.P. (NYSE:TGP), and Spectrum Pharmaceuticals, Inc. (NASDAQ:SPPI). This group of stocks’ market values are similar to INN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WIRE | 16 | 42071 | 4 |

| TCBK | 9 | 35706 | -1 |

| TGP | 8 | 39655 | 0 |

| SPPI | 13 | 66199 | -4 |

| Average | 11.5 | 45908 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.5 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $14 million in INN’s case. Encore Wire Corporation (NASDAQ:WIRE) is the most popular stock in this table. On the other hand Teekay LNG Partners L.P. (NYSE:TGP) is the least popular one with only 8 bullish hedge fund positions. Summit Hotel Properties Inc (NYSE:INN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately INN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); INN investors were disappointed as the stock returned 3.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.