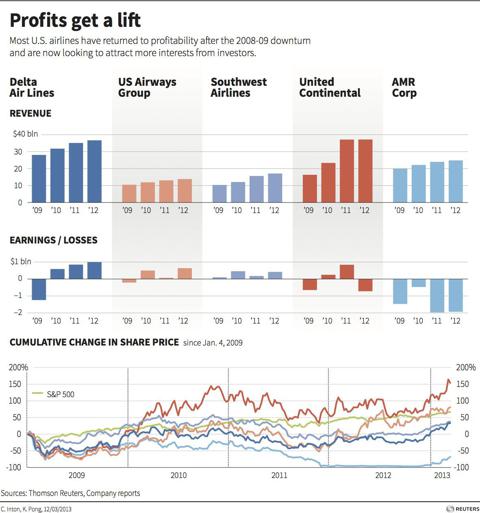

Thomson Reuters compared the revenue and profit figures of 5 of the most emblematic airlines in the U.S. A lot of progress has been made since the 2008-09 downturn. However, to date, only Southwest Airlines Co. (NYSE:LUV), Delta Air Lines, Inc. (NYSE:DAL) and US Airways Group, Inc. (NYSE:LCC) are profitable. And Southwest’s total revenue size is much smaller in comparison with Delta Air Lines, yet the proportion of total revenue that is being converted into profit is more attractive.

To confirm this, I look at last year’s margins. Delta Airlines had a 40.94 gross margin, 5.93% operating margin and 2.8% EBT margin last year.Impressive but not the best. Southwest had a gross margin of 56.0%, an operating margin of 3.65% and a EBT margin of 4.01% last year.

In the latest earnings announcement, Southwest reported record revenues but the profit figures slipped. Luckily, there is an explanation for that. I believe that Southwest’s integration process with AirTran Airways is not completely over. Eventually, the advantages obtained by owing AirTran Airways (notice that most of AirTran Airway’s routes did not overlap with Southwest) will offset any extra costs born after the integration.

There are certain exogenous factors that could affect Southwest Airlines Co. (NYSE:LUV)’s margins in the future. For example, Basili Alukos reminds us that the tax percentage on airfare has tripled to about 20% of the price of a ticket today since the 70’s, and will continue raising. Furthermore, the company employs 40,000 people, of which 80% or more are unionized. But these risks affect not only Southwest, they are common in the industry.

The catalyst everybody is waiting for

Now, if fuel prices decrease, Southwest would be much better off in comparison to other major airlines. Because they are a budget airline, they have a very efficient cost structure. However, fuel costs are not something you can directly control. They currently represent 36% of operating expenses. If fuel prices were to decrease, Southwest’s competitive advantage would increase massively, as their main operating expense decreases. Fundamental Global Investors has estimated that a 15% decrease in Brent crude provides incremental EPS of $0.65 a share, assuming the current hedge of 15% of 2013 oil consumption. But will fuel prices actually decrease this year? The latest price movements (3 months) in Brent crude oil gives us some hope, but it is too early to make any final prediction.

References

Data comes from Morning Star. Old School value spread sheet was used for the valuation. We used a report from Fundamental Global Investors (Kyle Cerminara) published on May 16th at SumZero.

Final Remarks

Airlines are known for being problematic. However, the current value, management commitment and balance sheet of Southwest suggest a buy with a long term investment horizon. At $14 per share, I identify Southwest as a bargain issue. Furthermore, if fuel prices were to decrease, Southwest could have a great year both in terms of profit and revenue size.

Price target: $20.00 / from N.A.

Rating: Buy / from N.A.

Investment Strategy: Value, Event

Investment Horizon: 1 year

Uncertainty: Medium

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Southwest Airlines.

The article Southwest Airlines: A Bargain? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.