A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Siliconware Precision Industries (ADR) (NASDAQ:SPIL).

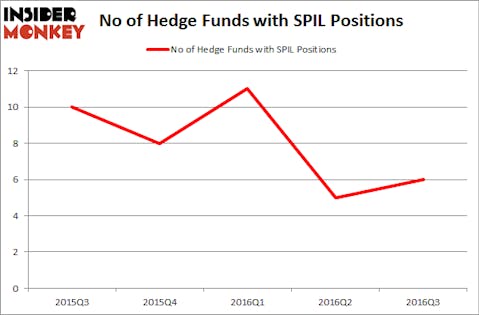

Is Siliconware Precision Industries (ADR) (NASDAQ:SPIL) a bargain? The best stock pickers are surely becoming hopeful. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings swelled by 1 recently. There were 6 hedge funds in our database with SPIL positions at the end of the 2016 third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Avid Technology, Inc. (NASDAQ:AVID), Primo Water Corporation (NASDAQ:PRMW), and Natural Gas Services Group, Inc. (NYSE:NGS) to gather more data points.

Follow Siliconware Precision Inds Co Lt (NASDAQ:SPIL)

Follow Siliconware Precision Inds Co Lt (NASDAQ:SPIL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Willyam Bradberry/Shutterstock.com

Now, we’re going to take a peek at the latest action encompassing Siliconware Precision Industries (ADR) (NASDAQ:SPIL).

How have hedgies been trading Siliconware Precision Industries (ADR) (NASDAQ:SPIL)?

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a boost of 20% from the second quarter of 2016. By comparison, 8 hedge funds held shares or bullish call options in SPIL heading into this year. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the most valuable position in Siliconware Precision Industries (ADR) (NASDAQ:SPIL), worth close to $11.8 million, comprising less than 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is OZ Management, led by Daniel S. Och, which holds a $2.4 million position; less than 0.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, John Overdeck and David Siegel’s Two Sigma Advisors and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names have been driving this bullishness. Navellier & Associates, led by Louis Navellier, initiated the most valuable position in Siliconware Precision Industries (ADR) (NASDAQ:SPIL). According to its latest 13F filing, the fund had $3,000 invested in the company at the end of the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Siliconware Precision Industries (ADR) (NASDAQ:SPIL). We will take a look at Avid Technology, Inc. (NASDAQ:AVID), Primo Water Corporation (NASDAQ:PRMW), Natural Gas Services Group, Inc. (NYSE:NGS), and THL Credit, Inc. (NASDAQ:TCRD). This group of stocks’ market values are closest to SPIL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVID | 17 | 93598 | 7 |

| PRMW | 17 | 73107 | 0 |

| NGS | 9 | 25344 | -1 |

| TCRD | 7 | 7707 | -2 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $50 million. That figure was $16 million in SPIL’s case. Avid Technology, Inc. (NASDAQ:AVID) is the most popular stock in this table. On the other hand THL Credit, Inc. (NASDAQ:TCRD) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Siliconware Precision Industries (ADR) (NASDAQ:SPIL) is even less popular than TCRD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none.