Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Signet Jewelers Limited (NYSE:SIG) based on that data.

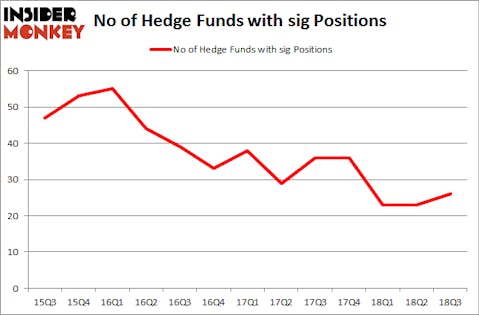

Signet Jewelers Limited (NYSE:SIG) was in 26 hedge funds’ portfolios at the end of the third quarter of 2018. SIG investors should pay attention to an increase in enthusiasm from smart money in recent months. There were 23 hedge funds in our database with SIG holdings at the end of the previous quarter. Our calculations also showed that sig isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s review the recent hedge fund action encompassing Signet Jewelers Limited (NYSE:SIG).

Hedge fund activity in Signet Jewelers Limited (NYSE:SIG)

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the previous quarter. On the other hand, there were a total of 36 hedge funds with a bullish position in SIG at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Orbis Investment Management was the largest shareholder of Signet Jewelers Limited (NYSE:SIG), with a stake worth $148.1 million reported as of the end of September. Trailing Orbis Investment Management was AQR Capital Management, which amassed a stake valued at $66.2 million. Select Equity Group, D E Shaw, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, key money managers have jumped into Signet Jewelers Limited (NYSE:SIG) headfirst. Orbis Investment Management, managed by William B. Gray, assembled the most valuable position in Signet Jewelers Limited (NYSE:SIG). Orbis Investment Management had $148.1 million invested in the company at the end of the quarter. Mark Kingdon’s Kingdon Capital also made a $13 million investment in the stock during the quarter. The other funds with new positions in the stock are Lee Ainslie’s Maverick Capital, Matthew Hulsizer’s PEAK6 Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Signet Jewelers Limited (NYSE:SIG) but similarly valued. We will take a look at Compania de Minas Buenaventura SA (NYSE:BVN), National Vision Holdings, Inc. (NASDAQ:EYE), Science Applications International Corp (NYSE:SAIC), and Telephone & Data Systems, Inc. (NYSE:TDS). This group of stocks’ market valuations are closest to SIG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BVN | 4 | 22280 | -3 |

| EYE | 17 | 430467 | 6 |

| SAIC | 24 | 186003 | 7 |

| TDS | 20 | 329985 | -2 |

| Average | 16.25 | 242184 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $242 million. That figure was $383 million in SIG’s case. Science Applications International Corp (NYSE:SAIC) is the most popular stock in this table. On the other hand Compania de Minas Buenaventura SA (NYSE:BVN) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Signet Jewelers Limited (NYSE:SIG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.